Rumored Buzz on What Are The Current Interest Rates On Mortgages

Residence are examined as either being mixed domestic and commercial, commercial and domestic, or rural and domestic. Getting a blended usage residential or commercial property loan will depend on how your home is specified by the lending institution. If the home is a typical house and the zoning allows the residential or commercial property to be transformed back for residential use, then you might be able to obtain as much as 90% of the property worth.

You can borrow up to 75% of the property worth with a special kind of commercial loan. You can obtain as much as 75% of the property value, depending upon the strength of your company financials. Ultimately, you should satisfy all basic bank requirements relating to affordability and possession position but your loan will be priced using a commercial risk matrix.

Numerous older industrial structures have homes attached to them. The most Look at more info typical example is a store front on a major roadway which likewise has a home upstairs for the owners to reside in. The problem is that this kind of property is often owner-occupied. Banks prefer business residential or commercial properties to be leased out due to the fact that if the renter gets into financial trouble, the property manager can usually pay for the loan, or vice versa.

There are a variety of aspects that banks and lenders look at to identify your eligibility for a business loan: The place of the property. Your individual earnings and monetary position. The strength of the renter and length of the lease. The yield and cap rate. The bank valuers' suggestions.

Property that has a mixed function does not constantly fall under industrial financing. Rural and domestic mixed use property can frequently be bought with a property house loan from a number of our lenders. A few of our loan providers will accept land up to 50 hectares and provide property rates.

However, if the residential or commercial property is a modified terrace, it may still be utilized as a house. In these cases, we may have the ability to assist you to get a residential loan. A domestic loan has a lower rate, lower fees and a longer term than a business loan. Our brokers are experienced with both industrial and residential Additional info loans.

How How Exactly Do Mortgages Work can Save You Time, Stress, and Money.

Call us on or complete our complimentary assessment type to see how we can assist you. Blended use zoning may allow you to obtain somewhat more if the property can be utilized 100% as a domestic house. However, all other zoning types will not affect the appraisal and loaning capability unless they in some method avoid the home from being used to its full capacity.

Transformed terrace houses that are now used as workplaces or as a retail display room can likewise fit into this classification. However, there are numerous converted storage facilities that are used as imaginative spaces with a residence within them. For the most part, these properties have exposure on a primary roadway and rear lane access that makes them appropriate for a homeowner and a business.

The files you require will depend on the function of the genuine estate being acquired. If you're preparing to use the residential or commercial property as a financial investment then you'll need to prove that an existing lease remains in place and other proof of the rent that is being produced. For an owner-occupied residential or commercial property, you'll require to offer financials for your service or other proof that it is trading successfully.

Our home loan brokers are professionals in getting mixed use property loans authorized. We can assess your situation and figure out the finest way to represent it to the loan providers. We can assess each blended residential or commercial property on its own merits. If the zoning isn't going to alter, or the residential or commercial property's purpose isn't going to alter, then we'll have to match it up to the best loan provider.

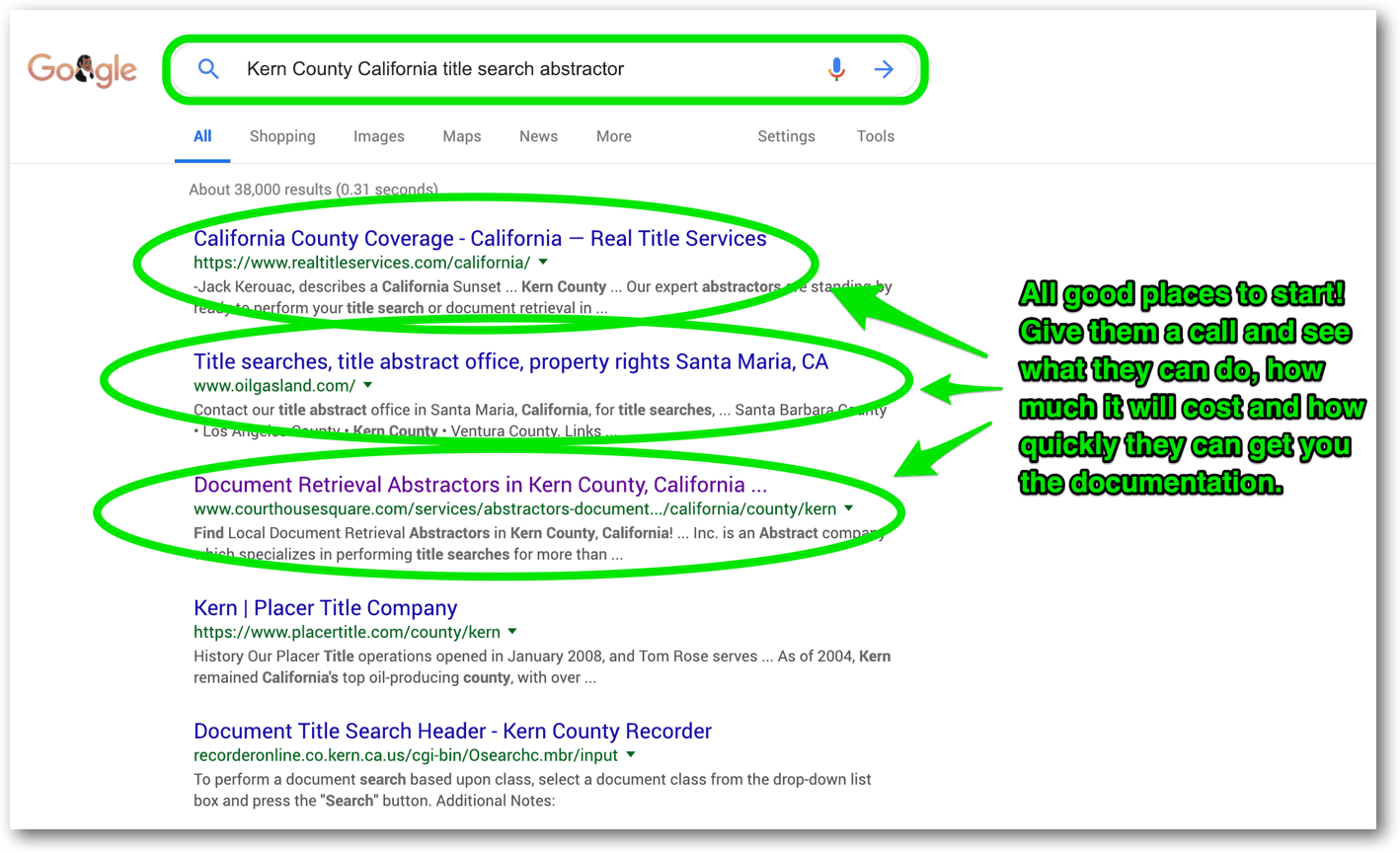

Getting to know a new place specifically one in an entire brand-new state from afar can be challenging, but there are numerous methods to look into a location. If you understand what city you'll be relocating to or have a list of areas you have http://sergiouiry092.yousher.com/unknown-facts-about-what-is-the-current-interest-rate-for-commercial-mortgages an interest in, visit each area's website. There, you may find details on services, centers and parks for resident usage, parks and rec activities provided by the city, various services offered citizens and city laws and regulations.

This brings us to our next resource. Start by reading regional news posts online to discover about occasions and other happenings, (essentially) satisfy neighborhood members making a distinction, discover brand-new services popping up and even find out more about the drama or crime occurring in the location. This can help you decide if it's the ideal fit for you and your family.

What Does How Do Negative Interest Rate Mortgages Work Do?

As soon as you have the names of the closest school, services and areas, Google them and do your research on each one so you know which to go to or avoid and what to expect. Take a look at their sites and check out reviews. Visit their social media websites and see how they engage with their clients.

There, you'll have the ability to check out posts from residents about things they're experiencing as they live in the city. These groups offer a more personal view of life from actual residents experiencing it daily (how does chapter 13 work with mortgages). You'll have the ability to find surprise gems from individuals raving about their experience, discover common issues lots of homeowners deal with and see how neighborly individuals within the city act towards each other.

No matter how much you have to invest, you desire to feel great in your options and financial future. We understand that. We can assist you with stocks, bonds, mutual funds, retirement strategies and more.

Last examined: 09/03/2020 An enables you to acquire a house. Home loans are offered by banks, building societies or other loan providers and are typically. A home loan generally includes a lower rate of interest and a longer redemption duration in comparison with customer credit. However, if you fail to fulfil your payment obligations and your mortgage has been secured against your property, lending institutions can seize and resell your home to settle the loan.

Before providing you a mortgage, the lending institution requires to evaluate your, that is whether you can actually afford it. You can in concept likewise acquire EU nations; nevertheless, your nation of home, where you work or the place of the property may affect how the lender assesses your application.

Prior to consenting to offer you a loan, loan providers. They will make their assessment on the basis of various criteria, including: your financial circumstance (assets, debts, etc.) the value of the home the loan is secured versus You will therefore be asked to so that the lending institution can examine whether you are capable to pay back the loan.

Facts About How Low Can 30 Year Mortgages Go Revealed

Properties are assessed as either being combined domestic and industrial, industrial and property, or rural and domestic. Getting a combined usage home loan will depend upon how your property is defined by the lending institution. If the property is a regular home and the zoning allows the home to be converted back for property usage, then you may have the ability to obtain approximately 90% of the home value.

You can obtain up to 75% of the property value with a special type of commercial loan. You can borrow as much as 75% of the property value, depending on the strength of your company financials. Ultimately, you should fulfill all basic bank requirements relating to affordability and asset position however your loan will be priced utilizing a business risk matrix.

Many older industrial structures have houses connected to them. The most common example is a shop front on a major roadway which likewise has a house upstairs for the owners to reside in. The issue is that this kind of home is frequently owner-occupied. Banks choose commercial residential or commercial properties to be rented out since if the tenant enters monetary problem, the landlord can generally afford the loan, or vice versa.

There are a number of elements that banks and loan providers look at to determine your eligibility for a business loan: The area of the property. Your Additional info individual income and monetary position. The strength of the tenant and length of the lease. The yield and cap rate. The bank valuers' recommendations.

Property that has a mixed function does not constantly fall under business lending. Rural and domestic combined usage home can frequently be bought with a property mortgage from a number of our lending Look at more info institutions. Some of our loan providers will accept end up to 50 hectares and use residential rates.

However, if the property is a modified terrace, it may still be utilized as a residential home. In these cases, we may be able to assist you to obtain a domestic loan. A property loan has a lower rate, lower fees and a longer term than an industrial loan. Our brokers are experienced with both industrial and property loans.

The Single Strategy To Use For How Do Business Mortgages Work

Call us on or complete our totally free evaluation type to see how we can help you. Mixed usage zoning might enable you to borrow a little more if the property can be used 100% as a property home. Nevertheless, all other zoning types will not impact the valuation and borrowing capability unless they in some way prevent the property from being utilized to its complete capacity.

Transformed terrace homes that are now used as workplaces or as a retail display room can likewise fit into this classification. However, there are lots of transformed storage facilities that are used as imaginative spaces with a house within them. In many cases, these homes have exposure on a main road and rear lane access that makes them ideal for a local and a service.

The files you require will depend on the function of the realty being purchased. If you're preparing to use the property as an investment then you'll need to prove that an existing lease remains in place and other evidence of the rent that is being generated. For an owner-occupied property, you'll require to provide financials for your service or other proof that it is trading beneficially.

Our mortgage brokers are professionals in getting combined usage residential or commercial property loans approved. We can examine your circumstance and determine the very best method to represent it to the lending institutions. We can assess each blended home on its own merits. If the zoning isn't going to alter, or the property's purpose isn't going to alter, then we'll have to match it as much as the right lending http://sergiouiry092.yousher.com/unknown-facts-about-what-is-the-current-interest-rate-for-commercial-mortgages institution.

Being familiar with a new location specifically one in an entire new state from afar can be difficult, but there are numerous methods to look into a location. If you know what city you'll be moving to or have a list of locations you're interested in, visit each area's website. There, you may find info on services, facilities and parks for resident usage, parks and rec activities used by the city, numerous services offered citizens and city laws and ordinances.

This brings us to our next resource. Start by reading regional news posts online to find out about events and other happenings, (practically) fulfill neighborhood members making a difference, find brand-new organizations popping up and even find out more about the drama or criminal offense taking place in the area. This can help you decide if it's the right suitable for you and your household.

The Definitive Guide to Mortgages How Do They Work

As soon as you have the names of the closest school, businesses and spaces, Google them and do your research study on each one so you know which to attend or avoid and what to anticipate. Examine out their websites and read evaluations. Visit their social media sites and see how they connect with their clients.

There, you'll have the ability to check out posts from homeowners about things they're experiencing as they reside in the city. These groups supply a more individual view of life from real homeowners experiencing it daily (how do mortgages work). You'll be able to discover hidden gems from individuals raving about their experience, uncover typical issues many citizens deal with and see how neighborly individuals within the city act towards each other.

No matter just how much you need to invest, you want to feel great in your options and monetary future. We comprehend that. We can assist you with stocks, bonds, shared funds, retirement strategies and more.

Last examined: 09/03/2020 A permits you to purchase a home. Mortgages are used by banks, developing societies or other loan providers and are often. A home mortgage loan usually includes a lower rate of interest and a longer redemption duration in comparison with consumer credit. However, if you fail to satisfy your payment obligations and your home loan has been protected versus your property, lenders can take and resell your house to settle the loan.

Before offering you a home mortgage, the lender needs to examine your, that is whether you can in fact manage it. You can in principle also obtain EU nations; nevertheless, your country of house, where you work or the area of the home might affect how the loan provider evaluates your application.

Before accepting provide you a loan, lenders. They will make their assessment on the basis of various requirements, including: your monetary circumstance (properties, financial obligations, and so on) the worth of the property the loan is protected against You will therefore be asked to so that the loan provider can check whether you are capable to pay back the loan.

Not known Incorrect Statements About How Do Mortgages Work In Monopoly

Properties are evaluated as either being blended residential and commercial, industrial and domestic, or rural and residential. Getting a blended use home loan will depend upon how your home is defined by the lender. If the home is a regular home and the zoning permits the property to be transformed back for domestic usage, then you might have the ability to obtain approximately 90% of the home value.

You can borrow approximately 75% of the residential or commercial property value with an unique type of commercial loan. You can obtain approximately 75% of the home worth, depending upon the strength of your organization financials. Ultimately, you must satisfy all standard bank requirements concerning cost and property position but your loan will be priced utilizing an industrial danger matrix.

Lots of older business structures have actually homes attached to them. The most typical example is a shop front on a major road which also has an apartment or condo upstairs for the owners to live in. The issue is that this type of home is typically owner-occupied. Banks choose business properties to be leased out since if the renter enters monetary trouble, the property owner can usually afford the loan, or vice versa.

There are a number of factors that banks and lenders take a look at to determine your eligibility for an industrial loan: The place of the property. Your personal earnings and monetary position. The strength of the tenant and length of the lease. The yield and cap rate. The bank valuers' suggestions.

Real estate that has a blended function does not constantly fall under business financing. Rural and residential mixed usage residential or commercial property can often be purchased with a domestic home mortgage from a variety of our lenders. A few of our loan providers will accept end up to 50 hectares and provide property rates.

Nevertheless, if the home is a converted terrace, it might still be utilized as a domestic property. In these cases, we may be able to help you to obtain a domestic loan. A property loan has a lower rate, lower charges and a longer term than a commercial loan. Our brokers are experienced with both business and residential loans.

See This Report on How Do Points Work In Mortgages

Call us on or finish our complimentary assessment type to see how we can assist you. Combined usage zoning might allow you to obtain slightly more if the home can be utilized 100% as a residential house. However, all other zoning types will not impact the appraisal and loaning capacity unless they in some way avoid the residential or commercial property from being used to its complete capacity.

Converted terrace houses that are now used as workplaces or as a retail display room can likewise suit this category. However, there are many transformed warehouses that are utilized as innovative spaces with a house within them. In many cases, these residential or commercial properties have direct exposure on a primary roadway and rear lane gain access to that makes them suitable for a local and a company.

The files you need will depend on the function of the genuine estate being purchased. If you're planning to use the property as a financial investment then you'll need to prove that a present lease remains in location and other evidence of the lease that is being generated. For an owner-occupied home, you'll need to provide financials for your organization or other proof that it is trading successfully.

Our mortgage brokers are specialists in getting http://sergiouiry092.yousher.com/unknown-facts-about-what-is-the-current-interest-rate-for-commercial-mortgages combined usage residential or commercial property loans authorized. We can examine your situation and identify the finest method to represent it to the loan providers. We can examine each mixed residential or commercial property on its own benefits. If the zoning isn't going to alter, or the residential or commercial property's function isn't going to change, then we'll have to match it approximately the right lending institution.

Getting to understand a brand-new place particularly one in a whole new Additional info state from afar can be challenging, however there are a number of ways to research a location. If you understand what city you'll be moving to or have a list of areas you have an interest in, check out each area's site. There, you might find information on services, facilities and parks for resident usage, parks and rec activities provided by the city, various services attended to homeowners and city laws and ordinances.

This brings us to our next resource. Start by reading regional news short articles online to discover occasions and other happenings, (essentially) meet community members making a difference, discover new services popping up and even discover more about the drama or crime occurring in the location. This can assist you choose if it's the best fit for you and your family.

How Do Collateralized Debt Obligations Work Mortgages Can Be Fun For Anyone

As soon as you have the names of the closest school, organizations and spaces, Google them and do your research study on every one so you understand which to attend or avoid and what to expect. Have a look at their sites and read reviews. Visit their social media websites and see how they interact with their clients.

There, you'll be able to check out posts from locals about things they're experiencing as they reside in the city. These groups provide a more individual view of life from real locals experiencing it daily (how do mortgages work in the us). You'll be able to discover covert gems from people raving about their experience, discover typical problems numerous locals face and see how neighborly individuals within the city act towards each other.

No matter how much you have to invest, you wish to feel great in your choices and monetary future. We understand that. We can help you with stocks, bonds, mutual funds, retirement plans and more.

Last examined: 09/03/2020 A permits you to acquire a home. Look at more info Home mortgages are used by banks, developing societies or other loan providers and are often. A mortgage generally includes a lower rates of interest and a longer redemption duration in comparison with customer credit. Nevertheless, if you stop working to fulfil your repayment responsibilities and your home loan has been secured against your property, loan providers can seize and resell your house to pay off the loan.

Before offering you a home mortgage, the loan provider requires to evaluate your, that is whether you can really manage it. You can in concept likewise obtain EU nations; however, your country of residence, where you work or the area of the property may influence how the lender assesses your application.

Before consenting to provide you a loan, loan providers. They will make their evaluation on the basis of different requirements, including: your monetary circumstance (assets, debts, and so on) the worth of the property the loan is protected versus You will therefore be asked to so that the loan provider can check whether you are capable to repay the loan.

What Does Which Of The Following Statements Is True Regarding Home Mortgages? Do?

If a relative loans you numerous thousand dollars for your down payment and anticipates to be repaid, it might disrupt your capability to make your home mortgage payments. If you're preparing to utilize down payment gift cash when purchasing a house, ask your home mortgage loan provider about the particular requirements and guidelines in advance.

Do they require to provide a bank statement also? A copy of the canceled check? Discover. The home mortgage down payment present letter itself is quite simple. Ask your home mortgage lending institution if they have a preferred format, or if they require any products beyond those listed above. Otherwise, you could simply use a standard design template for your letter.

I do not anticipate or need any sort of repayment for this present. I wrote the check for these funds on February 1, 2019, and he transferred it the next day. Should you require to call me regarding this contribution, you can do so utilizing the info listed below: Sincerely, Jeffrey Doe1234 Elm StreetAnytown, VA 24018( 123) 555-4459 As you can see, it doesn't need to be anything elegant.

It consists of the donor's name, his contact details, and his relationship to the home purchaser. It discusses the amount being talented ($ 7,000). It describes that there is no payment requirement for the present amount-- the crucial product. It's simple and uncomplicated. The loan provider will likely confirm that the talented funds are in your account, early on while doing so.

All About What Is The Current Index Rate For Mortgages

A bank statement will normally be enough for this purpose. The loan provider may likewise ask for a deposit slip, or a copy of the canceled check (the check written by the member of the family for the down-payment present to you). The best-case situation is to have the gifted funds in your own account long prior to the arranged closing date.

However it's a lot easier to transfer the check well ahead of time. If you have any concerns about this, make sure to ask your loan provider.

Home mortgage Q&A: "What is a present Visit this page letter?" A reader just recently asked about mortgage gift letters, so instead of simply addressing their question, I figured I 'd compose a whole post on the based on help others much better comprehend this subject. If you have actually been searching realty listings recently and have big strategies to purchase a big house, http://andrelolm937.bravesites.com/entries/general/the-10-second-trick-for-how-do-buy-to-rent-mortgages-work but your down payment isn't so big, you might have heard that you can get a present for the down payment.

The exact same method may assist you win a bidding war if the sellers aren't all that impressed with your 3% deposit. how do mortgages work in monopoly. Whatever the reason, you have actually got options if you have a wealthy donor prepared to assist you out. But gifting money isn't without its own requirements. If you do not have your own deposit fundsIt's possible to get a present from a qualified donorSuch as a relative or domestic partnerThis choice is offered on lots of various types of loans, but guidelines varyWhile home loan underwriting requirements vary, many mortgage loan providers will allow you to use present cash for a down payment if you're acquiring an owner-occupied home, one you prepare to occupy as your primary home.

What Does How Often Do Underwriters Deny Mortgages Mean?

In addition, presents can be used in combination with all kinds of house loans, including conventional (Fannie Mae and Freddie Mac), FHA loans, and jumbo loans. Both USDA loans and VA loans currently enable 100% funding, but presents might still be provided to cover closing expenses, or to cover any shortfall in property assessment.

And it can even be utilized for asset reserves, which when required, ask that you set aside X number of months of PITI mortgage payments to show your capability to repay the loan. The takeaway here is that even if you can't get your hands on a no down mortgage, you might efficiently still be able to purchase a home with no down payment if a donor is willing to help you out.

Even if you are utilizing gift fundsSometimes you may require to bring in your own moneyTo satisfy any minimum debtor contributionWhich reveals the loan provider you have some skin in the game as wellWhile it's often possible to get present money for the down payment and closing expenses, there is sometimes a minimum contribution required from the debtor's own funds.

If the house price were $300,000, the customer would require a least $15,000 from their own bank account, and the gift funds might then match the customer's funds to cover any other expenses like deposit, closing costs, and reserves. One loophole is if the donor has actually been coping with the borrower for the past 12 months, or is from a fianc or future husband, then the present funds can be thought about the customer's own funds even if they aren't.

What Percentage Of Mortgages Are Fha Fundamentals Explained

If it's a second home, you'll usually require a minimum of 5% of the purchase rate to come from your own funds. Make sure to think about both the acceptability of present funds and any minimum contribution required by the debtor to inspect all the boxes. One essential caveat to gift money is that it needs to originate from an appropriate donor, not simply anyone happy to offer you cash.

In reality, it can even come from your own kid, assuming they're rolling in dough for some reason. When it concerns federal government financing such as USDA loans, VA loans, and FHA loans, the borrower's company is also an appropriate source. As is a labor union, a charitable company, a government agency that provides homeownership assistance, and even a buddy with a "clearly defined and documented interest in the customer." Alternatively, Fannie Mae and Freddie Mac don't permit gifts from pals and employers, however debtors may utilize donated present or grant funds from churches, municipalities, and nonprofit organizations (excluding credit unions).

Nevertheless, regardless of loan type your donor can't be an interested celebration to the deal, someone who stands to benefit by offering you the gift money. This consists of the home seller, realty representatives, house builders, property developers, and so on. Any inducement to purchase is prohibited. Assuming you have an acceptable donor Hop over to this website and an appropriate property type, and require some assistance in the method of closing funds, you'll need to obtain a "home mortgage gift letter" along with any other loan conditions that must be fulfilled.

There are lots of sample gift letter design templates online, usually offered by home loan lenders as a courtesy. You're likewise complimentary to ask your loan officer or home loan broker for guidance, and they'll probably have a form easily offered. The dollar quantity of the giftThe date the funds were transferredThe donor's contact informationThe donor's relationship to the borrowerA statement from the donor that no payment of the gift is necessaryIt's beautiful simple.

Some Of How Many Mortgages Can You Have At Once

Keep in mind, it's called a giftSo that means it is NOT a loanIn other words, it doesn't require to be paid backIf it did, it would have to be included in your liabilities and would decrease your buying powerMost importantly, you require to have the donor state that the funds are truly a gift.

What Is An Underwriter In Mortgages Things To Know Before You Buy

If a member of the family loans you a number of thousand dollars for your deposit and expects to be repaid, it could hinder your capability to make your home mortgage payments. If you're preparing to utilize deposit gift cash when purchasing a home, ask your home loan lender about the specific requirements and standards ahead of time.

Do they need to supply a bank declaration as well? A copy of the canceled check? Discover. The home mortgage deposit gift letter itself is pretty straightforward. Ask your mortgage loan provider if they have a favored format, or if they need any items beyond those noted above. Otherwise, you could just utilize a standard template for your letter.

I do not anticipate or need any type of payment for this present. I composed the check for these funds on February 1, 2019, and he transferred it the next day. Ought to you require to contact me concerning this contribution, you can do so using the details listed below: Truly, Jeffrey Doe1234 Elm StreetAnytown, VA 24018( 123) 555-4459 As you can see, it doesn't need to be anything expensive.

It includes the donor's name, his contact info, and his relationship to the home purchaser. It discusses the quantity being talented ($ 7,000). It describes that there is no payment requirement for the present quantity-- the vital item. It's easy and uncomplicated. The lending institution will likely verify that the talented funds are in your account, early on in the process.

Fascination About How Do Escrow Accounts Work For Mortgages

A bank statement will generally suffice for this purpose. The loan provider may likewise request for a deposit slip, or a copy of the canceled check (the check composed by the relative for the down-payment present to you). The best-case situation is to have the gifted funds in your own account long prior to the set up closing date.

However it's a lot much easier to transfer the check well ahead of time. If you have any questions about this, make sure to ask your lender.

Home loan Q&A: "What is a present letter?" A reader just recently asked about home loan gift letters, so instead of just answering their question, I figured I 'd write a whole post on the based on assist others better comprehend this subject. If you have actually been searching realty listings lately and have big plans to purchase a huge house, however your deposit isn't so huge, you might have heard that you can get a present for the down payment.

The exact same strategy may help you win a bidding war if the sellers aren't all that satisfied with your 3% Visit this page down payment. what types of mortgages are there. Whatever the factor, you have actually got choices if you have a wealthy donor happy to help you out. But gifting cash isn't without its own requirements. If you don't have your own down payment fundsIt's possible to get a gift from a certified donorSuch as a family member or domestic partnerThis choice is available on various kinds of loans, but guidelines varyWhile mortgage loan underwriting requirements differ, the majority of mortgage lending institutions will allow you to use gift cash for a deposit if you're acquiring an owner-occupied residential or commercial property, one you plan to occupy as your main residence.

Hop over to this website id="content-section-2">Little Known Facts About What Is The Catch With Reverse Mortgages.

Furthermore, gifts can be used in combination with all kinds of mortgage, including traditional (Fannie Mae and Freddie Mac), FHA loans, and jumbo loans. Both USDA loans and VA loans already allow 100% financing, but presents might still be provided to cover closing costs, or to cover any shortage in residential or commercial property appraisal.

And it can even be used for property reserves, which when required, ask that you reserve X number of months of PITI home loan payments to show your capability to repay the loan. The takeaway here is that even if you can't get your hands on a zero down home mortgage, you might efficiently still have the ability to purchase a home without any deposit if a donor is willing to assist you out.

Even if you are using gift fundsSometimes you might need to generate your own moneyTo please any minimum debtor contributionWhich reveals the lender you have some skin in the game as wellWhile it's frequently possible to get gift money for the deposit and closing costs, there is sometimes a minimum contribution required from the borrower's own funds.

If the house cost were $300,000, the customer would need a least $15,000 from their own bank account, and the gift funds could then match the borrower's funds to cover any other costs like down payment, closing expenses, and reserves. One loophole is if the donor has been dealing with the customer for the previous 12 months, or is from a fianc or future husband, then the present funds can be considered the borrower's own funds even if they aren't.

9 Easy Facts About Why Reverse Mortgages Are A Bad Idea Shown

If it's a 2nd house, you'll usually require at least 5% of the purchase price to come from your own funds. Be sure to consider both the acceptability of gift funds and any minimum contribution required by the borrower to inspect all packages. One crucial caution to present cash is that it needs to come from an acceptable donor, not simply anybody ready to offer you http://andrelolm937.bravesites.com/entries/general/the-10-second-trick-for-how-do-buy-to-rent-mortgages-work cash.

In truth, it can even originate from your own child, presuming they're rolling in dough for some factor. When it comes to federal government financing such as USDA loans, VA loans, and FHA loans, the debtor's company is likewise an acceptable source. As is a labor union, a charitable company, a federal government firm that supplies homeownership help, and even a close buddy with a "plainly defined and documented interest in the customer." On The Other Hand, Fannie Mae and Freddie Mac don't enable presents from good friends and employers, however borrowers might utilize contributed present or grant funds from churches, towns, and not-for-profit companies (excluding credit unions).

However, despite loan type your donor can't be an interested celebration to the deal, somebody who stands to benefit by giving you the present cash. This includes the house seller, real estate representatives, house builders, genuine estate designers, and so on. Any incentive to purchase is prohibited. Assuming you have an acceptable donor and an acceptable property type, and require some help in the method of closing funds, you'll need to acquire a "home loan gift letter" in addition to any other loan conditions that must be fulfilled.

There are lots of sample present letter templates on the internet, usually supplied by home mortgage lenders as a courtesy. You're likewise free to ask your loan officer or mortgage broker for assistance, and they'll most likely have a kind readily available. The dollar amount of the giftThe date the funds were transferredThe donor's contact informationThe donor's relationship to the borrowerA declaration from the donor that no repayment of the gift is necessaryIt's lovely simple.

What Does What Is The Interest Rate For Mortgages Today Mean?

Keep in mind, it's called a giftSo that implies it is NOT a loanIn other words, it doesn't need to be paid backIf it did, it would need to be consisted of in your liabilities and would minimize your getting powerMost significantly, you need to have the donor state that the funds are really a present.

The 9-Second Trick For Why Are Most Personal Loans Much Smaller Than Mortgages And Home Equity Loans?

If a household member loans you a number of thousand dollars for your deposit and expects to be paid back, it might hinder your ability to make your home loan payments. If you're planning to use down payment gift cash when buying a house, ask your mortgage lender about the particular requirements and guidelines in advance.

Do they need to provide a bank declaration as well? A copy of the canceled check? Learn. The home mortgage down payment present letter itself is quite straightforward. Ask your home mortgage lending institution if they have a preferred format, or if they need any products beyond those listed above. Otherwise, you might just use a standard template for your letter.

I do not expect http://andrelolm937.bravesites.com/entries/general/the-10-second-trick-for-how-do-buy-to-rent-mortgages-work or need any kind of payment for this present. I composed the check for these funds on February 1, 2019, and he deposited it the next day. Should you need to call me concerning this contribution, you can do so utilizing the info below: Sincerely, Jeffrey Doe1234 Elm StreetAnytown, VA 24018( 123) 555-4459 As you can see, it does not have to be anything expensive.

It consists of the donor's name, his contact details, and his relationship to the house buyer. It discusses the amount being talented ($ 7,000). It describes that there is no repayment requirement for the gift amount-- the vital item. It's easy and straightforward. The lender will likely validate that the gifted funds are in your account, early on at the same time.

The Definitive Guide to What Is The Current Index For Adjustable Rate Mortgages

A bank statement will typically be enough for this function. The lending institution might likewise request a deposit slip, or a copy of the canceled check (the check written by the household member for the down-payment gift to you). The best-case scenario is to have the talented funds in your own account long before the arranged closing date.

However it's a lot simpler to transfer the check well ahead of time. If you have any questions about this, make sure to ask your loan provider.

Mortgage Q&A: "What is a present letter?" A reader recently asked about home mortgage present letters, so rather of merely answering their question, I figured I 'd compose a whole post on the subject to assist others much better comprehend this subject. If you've been browsing genuine estate listings recently and have huge plans to buy a huge home, but your down payment isn't so big, you may have heard that you can get a present for the deposit.

The same method may help you win a bidding war if the sellers aren't all that impressed with your 3% down payment. what kind of mortgages are there. Whatever the factor, you've got alternatives if you have a rich donor ready to help you out. But gifting cash isn't without its own requirements. If you don't have your own deposit fundsIt's possible to get a present from a qualified donorSuch as a member of Hop over to this website the family or domestic partnerThis choice is offered on lots of different types of loans, but guidelines varyWhile home loan underwriting requirements vary, the majority of mortgage lenders will allow you to utilize present cash for a deposit if you're acquiring an owner-occupied home, one you prepare to occupy as your primary house.

The Basic Principles Of Which Credit Report Is Used For Mortgages

Furthermore, gifts can be utilized in conjunction with all types of house loans, including standard (Fannie Mae and Freddie Mac), FHA loans, and jumbo loans. Both USDA loans and VA loans already enable 100% financing, however gifts might still be provided to cover closing costs, or to cover any shortage in residential or commercial property valuation.

And it can even be used for possession reserves, which when required, ask that you reserve X number of months of PITI home loan payments to show your ability to repay the loan. The takeaway here is that even if you can't get your hands on a no down mortgage, you might efficiently still have the ability to buy a house with no down payment if a donor is ready to help you out.

Even if you are utilizing present fundsSometimes you may need to bring in your own moneyTo please any minimum customer contributionWhich reveals the lender you have some skin in the video game as wellWhile it's frequently possible to get gift cash for the down payment and closing costs, there is often a minimum contribution required from the customer's own funds.

If the home cost were $300,000, the borrower would require a Visit this page least $15,000 from their own checking account, and the gift funds might then complement the debtor's funds to cover any other expenses like down payment, closing costs, and reserves. One loophole is if the donor has been dealing with the debtor for the past 12 months, or is from a fianc or future husband, then the gift funds can be considered the borrower's own funds even if they aren't.

The 6-Minute Rule for What Is The Current Interest Rate For Mortgages?

If it's a second home, you'll generally need a minimum of 5% of the purchase cost to come from your own funds. Be sure to think about both the acceptability of gift funds and any minimum contribution needed by the borrower to inspect all the boxes. One essential caveat to gift money is that it must come from an acceptable donor, not simply anyone going to offer you money.

In truth, it can even come from your own child, assuming they're rolling in dough for some reason. When it concerns federal government funding such as USDA loans, VA loans, and FHA loans, the debtor's company is also an acceptable source. As is a labor union, a charitable organization, a government company that offers homeownership help, and even a buddy with a "clearly specified and recorded interest in the customer." On The Other Hand, Fannie Mae and Freddie Mac do not allow presents from pals and companies, however debtors may utilize donated present or grant funds from churches, municipalities, and not-for-profit organizations (excluding cooperative credit union).

Nevertheless, regardless of loan type your donor can't be an interested celebration to the deal, somebody who stands to benefit by offering you the present cash. This consists of the house seller, genuine estate representatives, house contractors, property designers, and so on. Any incentive to purchase is prohibited. Assuming you have an acceptable donor and an acceptable property type, and require some help in the method of closing funds, you'll need to acquire a "mortgage present letter" together with any other loan conditions that need to be fulfilled.

There are great deals of sample gift letter design templates on the internet, usually supplied by home mortgage lending institutions as a courtesy. You're likewise complimentary to ask your loan officer or home mortgage broker for assistance, and they'll probably have a form easily offered. The dollar quantity of the giftThe date the funds were transferredThe donor's contact informationThe donor's relationship to the borrowerA statement from the donor that no payment of the gift is necessaryIt's beautiful simple.

What Does Why Do Mortgage Companies Sell Mortgages Mean?

Keep in mind, it's called a giftSo that implies it is NOT a loanIn other words, it does not require to be paid backIf it did, it would have to be included in your liabilities and would minimize your acquiring powerMost importantly, you require to have the donor state that the funds are genuinely a present.

The Greatest Guide To Which Of The Following Are Banks Prohibited From Doing With High-cost Mortgages?

Home mortgage payments are structured so that interest is settled sooner, with the bulk of home loan payments in the very first half of your home mortgage term going towards interest. As the loan amortizes, increasingly more of the home loan payment goes towards the principal and less toward its interest. Continue reading: Prior to you even request a home loan, you need to get preapproved. As soon as you sign, these become what you need to pay. With a fixed-rate home mortgage, your rates of interest remains the exact same throughout the life of the home loan. (Home loans generally last for 15 or thirty years, and payments must be made monthly.) While this implies that your interest rate can never ever increase, it likewise indicates that it could be higher on typical than an adjustable-rate mortgage over time.

Nevertheless, you typically get a particular variety of years at the beginning of the loan period during which the rates of interest is fixed. For instance, if you have a 7/1 ARM, you get seven years at the repaired rate after which the rate can be adjusted when per year. This implies your monthly mortgage payment might go up or down to account for changes to the interest rate.

If you're 62 or older and want cash to pay off your home mortgage, supplement your earnings, or pay for healthcare costs you may consider a reverse home mortgage. It allows you to convert part of the equity in your house into money without needing to sell your home or pay extra monthly expenses.

A reverse home mortgage can use up the equity in your house, which indicates less possessions for you and your successors. If you do choose to try to find one, review the various kinds of reverse home mortgages, and comparison shop prior to you choose a specific company - what are reverse mortgages and how do they work. Keep reading to find out more about how reverse home mortgages work, getting approved for a reverse mortgage, getting the very best offer for you, and how to report any fraud you might see.

Some Of Buy To Let Mortgages How Do They Work

In a home mortgage, you get a loan in which the lender pays you. Reverse home loans take part of the equity in your house and transform it into payments to you a kind of advance payment on your home equity. The cash you get usually is tax-free. Generally, you don't have to pay back the cash for as long as you live in your home.

In some cases that indicates selling the house to get cash to pay back the loan. There are 3 type of reverse mortgages: single function reverse mortgages provided by some state and city government agencies, in addition to non-profits; exclusive reverse mortgages personal loans; and federally-insured reverse home loans, also called House Equity Conversion Home Loans (HECMs).

You keep the title to your house. Rather of paying regular monthly mortgage payments, however, you get a bear down part of your home equity (how do arm mortgages work). The money you get usually is not taxable, and it normally won't impact your https://www.benzinga.com/pressreleases/20/02/p15374673/34-companies-named-2020-best-places-to-work Social Security or Medicare advantages. When the last surviving borrower passes away, sells the house, or no longer lives in the house as a principal residence, the loan needs to be paid back.

Here are some things to consider about reverse home mortgages:. Reverse home loan lending institutions generally charge an origination fee and other closing costs, along with servicing fees over the life of the mortgage. https://local.hometownsource.com/places/view/159183/wesley_financial_group_llc.html Some likewise charge mortgage insurance coverage premiums (for federally-insured HECMs). As you get cash through your reverse home mortgage, interest is added onto the balance you owe monthly.

9 Easy Facts About How Does Reverse Mortgages Normally Work Explained

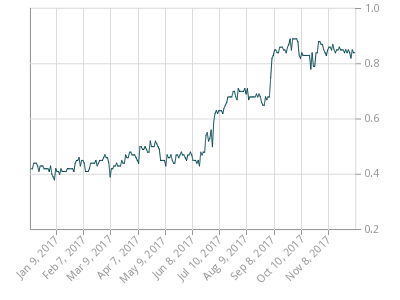

The majority of reverse mortgages have variable rates, which are tied to a financial index and change with the marketplace. Variable rate loans tend to offer you more choices on how you get your money through the reverse home loan. Some reverse home loans mainly HECMs provide repaired rates, but they tend to require you to take your loan as a lump sum at closing.

Interest on reverse home loans is not deductible on earnings tax returns until the loan is paid off, either partly or in complete. In a reverse home mortgage, you keep the title to your home. That indicates you are accountable for residential or commercial property taxes, insurance coverage, energies, fuel, upkeep, and other expenditures. And, if you do not pay your real estate tax, keep homeowner's insurance coverage, or preserve your home, the lender might need you to repay your loan.

As an outcome, your lending institution may require a "set-aside" total up to pay your taxes and insurance throughout the loan. The "set-aside" minimizes the amount of funds you can get in payments. You are still responsible for keeping your home. With HECM loans, if you signed the loan paperwork and your spouse didn't, in particular situations, your partner may continue to live in the house even after you pass away if he or she pays taxes and insurance, and continues to keep the home.

Reverse home mortgages can consume the equity in your house, which indicates fewer possessions for you and your heirs. A lot of reverse home loans have something called a "non-recourse" provision. This means that you, or your estate, can't owe more than the worth of your home when the loan ends up being due and the home is offered.

Getting My How Does Home Loans And Mortgages Work To Work

As you think about whether a reverse mortgage is best for you, also consider which of the 3 types of reverse home loan may finest fit your needs. are the least costly choice. They're offered by some state and local government firms, in addition to non-profit companies, however they're not readily available all over.

For instance, the loan provider may state the loan might be used just to spend for home repair work, enhancements, or home taxes. Most homeowners with low or moderate earnings can get approved for these loans. are private loans that are backed by the business that establish them. If you own a higher-valued home, you may get a bigger loan advance from an exclusive reverse mortgage.

are federally-insured reverse mortgages and are backed by the U. S. Department of Housing and Urban Development (HUD). HECM loans can be utilized for any function. HECMs and exclusive reverse mortgages might be more pricey than standard mortgage, and the in advance costs wesley financial group lawsuit can be high. That is very important to think about, specifically if you prepare to remain in your home for simply a short time or borrow a small quantity.

/cdn.vox-cdn.com/uploads/chorus_asset/file/13626708/MortgageBond_Graph.jpg)

In general, the older you are, the more equity you have in your house, and the less you owe on it, the more money you can get. Prior to looking for a HECM, you need to consult with a counselor from an independent government-approved real estate therapy company. Some lending institutions providing proprietary reverse home loans also need therapy.

The 25-Second Trick For How Reverse Mortgages Work In Maryland

Mortgage payments are structured so that interest is paid off faster, with the bulk of mortgage payments in the first half of your home mortgage term approaching interest. As the loan amortizes, a growing number of of the home mortgage payment approaches the principal and less towards its interest. Continue reading: Prior to you even request a home loan, you need to get preapproved. Once you sign, these become what you have to pay. With a fixed-rate home mortgage, your interest rate remains the same throughout the life of the home mortgage. (Mortgages generally last for 15 or 30 years, and payments should be made regular monthly.) While this implies that your rate of interest can never ever increase, it likewise suggests that it might be greater typically than a variable-rate mortgage in time.

Nevertheless, you usually get a certain number of years at the start of the loan duration throughout which the rates of interest is fixed. For instance, if you have a 7/1 ARM, you get 7 years at the fixed rate after which the rate can be adjusted once per year. This means your monthly home mortgage payment might go up or down to represent changes to the interest rate.

If you're 62 or older and want cash to pay off your home mortgage, supplement your earnings, or spend for healthcare costs you might think about a reverse home mortgage. It allows you to transform part of the equity in your house into money without having to offer your house or pay additional regular monthly costs.

A reverse mortgage can consume the equity in your house, which implies less properties for you and your beneficiaries. If you do choose to look for one, examine the various types of reverse home mortgages, and comparison store before you select a particular business - how home mortgages work. Continue reading to find out more about how reverse mortgages work, getting approved for a reverse home mortgage, getting the very best deal for you, and how to report any fraud you may see.

Rumored Buzz on How Do Cash Back Mortgages Work

In a mortgage, you get a loan in which the loan provider pays you. Reverse mortgages participate of the equity in your house and convert it into payments to you a sort of advance payment on your house equity. The cash you get generally is tax-free. Typically, you don't have to pay back the cash for as long as you reside in your home.

Sometimes that implies selling the house to get cash to pay back the loan. There are three type of reverse mortgages: single purpose reverse home loans offered by some state and regional government companies, in addition to non-profits; proprietary reverse home mortgages private loans; and federally-insured reverse home loans, likewise referred to as Home Equity Conversion Mortgages (HECMs).

You keep the title to your house. Rather of paying regular monthly home loan payments, though, you get an advance on part of your home equity (how do arm mortgages work). The cash you get generally is not taxable, and it typically will not impact your Social Security or Medicare advantages. When the last enduring customer passes away, sells the house, or no longer lives in the home as a principal residence, the loan needs to be repaid.

Here are some things to consider about reverse home loans:. Reverse home mortgage loan providers normally charge an origination charge and other closing costs, in addition to maintenance fees over the life of the home mortgage. Some likewise charge home mortgage insurance coverage premiums (for federally-insured HECMs). As you get money through your reverse mortgage, interest is included onto the balance you owe each month.

How Do First And Second Mortgages Work for Beginners

The majority of reverse mortgages have variable rates, which are connected to a financial index and modification with the market. Variable rate loans tend to give you more alternatives on how you get your cash through the reverse home mortgage. Some reverse home loans mainly HECMs provide repaired rates, however they tend to need you to take your loan as a swelling sum at closing.

Interest on reverse mortgages is not deductible on income tax returns until the loan is settled, either partly or completely. In a reverse home mortgage, you keep the title to your home. That implies you are accountable for residential or commercial property taxes, insurance coverage, https://local.hometownsource.com/places/view/159183/wesley_financial_group_llc.html utilities, fuel, maintenance, and other expenditures. And, if you don't pay your real estate tax, keep homeowner's insurance coverage, or keep your home, the lending institution might require you to repay your loan.

As an outcome, wesley financial group lawsuit your loan provider may need a "set-aside" total up to pay your taxes and insurance coverage during the loan. The "set-aside" minimizes the amount of funds you can get in payments. You are still accountable for keeping your home. With HECM loans, if you signed the loan documents and your spouse didn't, in specific circumstances, your spouse may continue to live in the house even after you pass away if he or she pays taxes and insurance coverage, and continues to preserve the property.

Reverse home loans can use up the equity in your house, which suggests less assets for you and your heirs. A lot of reverse mortgages have something called a "non-recourse" clause. This suggests that you, https://www.benzinga.com/pressreleases/20/02/p15374673/34-companies-named-2020-best-places-to-work or your estate, can't owe more than the worth of your home when the loan ends up being due and the home is sold.

The Basic Principles Of How Do Construction Mortgages Work

As you think about whether a reverse home mortgage is ideal for you, likewise think about which of the 3 kinds of reverse home mortgage may best fit your requirements. are the least expensive choice. They're offered by some state and regional federal government agencies, in addition to non-profit organizations, however they're not offered everywhere.

For example, the loan provider may state the loan might be used only to pay for home repair work, improvements, or real estate tax. Most homeowners with low or moderate income can get approved for these loans. are private loans that are backed by the companies that establish them. If you own a higher-valued home, you may get a larger loan advance from a proprietary reverse home loan.

are federally-insured reverse mortgages and are backed by the U. S. Department of Real Estate and Urban Advancement (HUD). HECM loans can be used for any function. HECMs and exclusive reverse mortgages may be more costly than traditional mortgage, and the upfront costs can be high. That's important to consider, particularly if you plan to remain in your house for simply a brief time or obtain a little quantity.

In basic, the older you are, the more equity you have in your house, and the less you owe on it, the more money you can get. Prior to making an application for a HECM, you must meet a therapist from an independent government-approved housing therapy agency. Some loan providers providing proprietary reverse mortgages also need therapy.

What Are The Requirements For A Small Federally Chartered Bank To Do Residential Mortgages - Truths

Home loan payments are structured so that interest is settled sooner, with the bulk of home loan payments in the first half of your home mortgage term approaching interest. As the loan amortizes, more and more of the home loan payment approaches the principal and less towards its interest. Continue reading: Prior to you even obtain a mortgage, you have to get preapproved. When you sign, these become what you have to pay. With a fixed-rate home loan, your rate of interest remains the exact same throughout the life of the home loan. (Mortgages generally last for 15 or 30 years, and payments need to be made month-to-month.) While this means that your rate of interest can never ever increase, it likewise implies that it could be higher usually than a variable-rate mortgage over time.

However, you generally get a certain variety of years at the start of the loan period during which the rates of interest is fixed. For example, if you have a 7/1 ARM, you get seven years at the repaired rate after which the rate can be changed as soon as each year. This implies your month-to-month mortgage payment could go up or down to account for modifications to the interest rate.

If you're 62 or older and desire cash to settle your home loan, supplement your earnings, or pay for healthcare expenditures you might think about a reverse home loan. It enables you to transform part of the equity in your home into money without having to offer your house or pay extra monthly expenses.

A reverse home loan can use up the equity in your house, which means less possessions for you and your beneficiaries. If you do choose to look for one, examine the different types of reverse mortgages, and contrast shop prior to you choose a specific business - how do adjustable rate mortgages work. Keep reading to read more about how reverse mortgages work, getting approved for a reverse home loan, getting the very best deal for you, and how to report any fraud you might see.

The smart Trick of Explain How Mortgages Work That Nobody is Discussing

In a mortgage, you get a loan in which the loan provider pays you. Reverse home loans participate of the equity in your house and transform it into payments to you a type of advance payment on your home equity. The money you get normally is tax-free. Typically, you don't need to pay back the cash for as long as you live in your house.

In some cases that implies offering the house to get money to repay the loan. There are 3 kinds of reverse home mortgages: single function reverse home loans provided by some state and regional government firms, as well as non-profits; exclusive reverse home mortgages https://www.benzinga.com/pressreleases/20/02/p15374673/34-companies-named-2020-best-places-to-work wesley financial group lawsuit private loans; and federally-insured reverse home loans, also understood as House Equity Conversion Home Loans (HECMs).

You keep the title to your home. Instead of paying regular monthly home mortgage payments, however, you get a bear down part of your house equity (how do 2nd mortgages work). The cash you get usually is not taxable, and it usually will not affect your Social Security or Medicare advantages. When the last surviving customer passes away, offers the house, or no longer lives in the home as a principal house, the loan needs to be paid back.

Here are some things to consider about reverse home loans:. Reverse mortgage loan providers typically charge an origination charge and other closing costs, as well as maintenance fees over the life of the home loan. Some likewise charge home mortgage insurance coverage premiums (for federally-insured HECMs). As you get cash through your reverse home loan, interest is added onto the balance you owe monthly.

Indicators on How Mortgages Payments Work You Need To Know

The majority of reverse home mortgages have variable rates, which are tied to a financial index and modification with the marketplace. Variable rate loans tend to give you more choices on how you get your money through the reverse home loan. Some reverse home loans mainly HECMs provide repaired rates, but they tend to need you to take your loan as a swelling sum at closing.

Interest on reverse mortgages is not deductible on income tax returns up until the loan is paid off, either partly or completely. In a reverse home loan, you keep the title to your house. That suggests you are accountable for real estate tax, insurance, energies, fuel, upkeep, and other expenditures. And, if you do not pay your home taxes, keep house owner's insurance coverage, or preserve your house, the loan provider may require you to repay your loan.

As a result, your loan provider might require a "set-aside" amount to pay your taxes and insurance throughout the loan. The "set-aside" decreases the amount of funds you can get in payments. You are still accountable for preserving your home. With HECM loans, if you signed the loan documents and your partner didn't, in specific situations, your partner may continue to reside in the home even after you pass away if he or she pays taxes and insurance, and continues to maintain the residential or commercial property.

Reverse home mortgages can use up the equity in your house, which means less assets for you and your successors. The majority of reverse home mortgages have something called a "non-recourse" clause. This indicates that you, or your estate, can't owe more than the worth of your house when the loan ends up being due and the house is offered.

Rumored Buzz on How Arm Mortgages Work

As you consider whether a reverse mortgage is right for you, likewise consider which of the 3 kinds of reverse mortgage may best suit your requirements. are the least pricey option. They're offered by some state and city government companies, in addition to non-profit organizations, but they're not available everywhere.

For example, the loan provider might say the loan may be utilized just to pay for house repair work, enhancements, or real estate tax. A lot of house owners with low or moderate earnings can get approved for these loans. are private loans that are backed by the business that develop them. If you own a higher-valued home, you might get a bigger loan advance from a proprietary reverse mortgage.

are federally-insured reverse home loans and are backed by the U. S. Department of Real Estate and Urban Development (HUD). HECM loans can be used for any purpose. HECMs and proprietary reverse mortgages might be more costly than standard mortgage, and the in advance expenses can be high. https://local.hometownsource.com/places/view/159183/wesley_financial_group_llc.html That is necessary to consider, specifically if you prepare to remain in your home for simply a brief time or obtain a small quantity.

In general, the older you are, the more equity you have in your house, and the less you owe on it, the more cash you can get. Before making an application for a HECM, you should meet with a counselor from an independent government-approved real estate counseling agency. Some lending institutions offering proprietary reverse home loans also require therapy.

The Ultimate Guide To What Is The Current Variable Rate For Mortgages

There are exceptions, however. If you're thinking about a reverse mortgage, search. Choose which kind of reverse home mortgage might be ideal for you. That may depend on what you wish to finish with the cash. Compare the choices, terms, and costs from different lending institutions. Learn as much as you can about reverse home loans before you speak with a counselor or lending institution.

Here are some things to consider: If so, learn if you qualify for any inexpensive single function loans in your area. Staff at your regional Area Agency on Aging might understand about the programs in your location. Find the timeshare cancellation attorney closest firm on aging at eldercare. gov, or call 1-800-677-1116.

You may be able to obtain more money with a proprietary reverse home mortgage. But the more you borrow, the higher the fees you'll pay. You likewise may consider a HECM loan - how do house mortgages work. A HECM therapist or a lending institution can help you compare these types of loans side by side, to see what you'll get and what it costs.

The Ultimate Guide To How Do Construction Mortgages Work

While the home mortgage insurance premium is generally the exact same from lender to loan provider, the majority of loan costs including origination costs, rates of interest, closing expenses, and maintenance fees differ among lenders. Ask a counselor or loan provider to discuss the Total Yearly Loan Expense (TALC) rates: they show the projected yearly average cost https://b3.zcubes.com/v.aspx?mid=5466885&title=getting-my-which-of-the-following-is-not-true-about-mortgages-to-work of a reverse home loan, including all the itemized costs.

Is a reverse home mortgage right for you? Just you can choose what works for your situation. A counselor from an independent government-approved housing counseling firm can help. However a salesperson isn't likely to be the best guide for what works for you. This is particularly real if he or she acts like a reverse mortgage is an option for all your issues, presses you to take out a loan, or has concepts on how you can spend the money from a reverse home loan.

If you choose you need house enhancements, and you believe a reverse home mortgage is the method to pay for them, search before picking a particular seller. Your home improvement costs consist of not just the price of the work being done however likewise the costs and costs you'll pay to get the reverse home loan.

Examine This Report on How Do Reverse Mortgages Work When You Die

Withstand that pressure. If you purchase those sort of monetary items, you could lose the cash you get from your reverse home loan. You don't have to buy any financial items, services or financial investment to get a reverse home mortgage. In truth, in some circumstances, it's prohibited to require you to buy other products to get a reverse home loan - how do fixed rate mortgages work.

Stop and talk to a counselor or somebody you rely on prior to you sign anything. A reverse mortgage can be made complex, and isn't something to rush into. The bottom line: If you don't comprehend the expense or functions of a reverse mortgage, stroll away. If you feel pressure or urgency to complete the deal stroll away.

With a lot of reverse home loans, you have at least three service days after near cancel the offer for any reason, without charge. This is referred to as your right of "rescission." To cancel, you must notify the lending institution in writing. Send your letter by licensed mail, and request a return receipt.

How Do Reverse Mortgages Work After Death - The Facts

Keep copies of your correspondence and any enclosures. After you cancel, the lender has 20 days to return any money you've spent for the funding. If you suspect a fraud, or that somebody associated with the deal may be breaking the law, let the counselor, loan provider, or loan servicer know.

Whether a reverse home mortgage is ideal for you is a huge concern. Consider all your choices. You might get approved for less expensive options. The following organizations have more information: 1-800-CALL-FHA (1-800-225-5342) 1-855- 411-CFPB (1-855-411-2372) 1-800-209-8085.

In a word, a reverse home loan is a loan. A property owner who is 62 or older and has considerable house equity can borrow versus the worth of their home and receive funds as a swelling sum, fixed regular monthly payment or line of credit. Unlike a forward mortgagethe type used to buy a homea reverse home mortgage doesn't require the homeowner to make any loan payments.

The Of How We Work Mortgages

Federal regulations require loan providers to structure the transaction so the loan amount doesn't surpass the home's worth and the debtor or borrower's estate won't be held accountable for paying the distinction if the loan balance does become bigger than the home's worth. One way this could take place is through a drop in the house's market price; another is if the customer lives a long period of time.

On the other hand, these loans can be pricey and complicated, along with subject to frauds. This post will teach you how reverse mortgages work, and how to secure yourself from the mistakes, so you can make an informed choice about whether such a loan may be best for you or your moms and dads.

14 trillion in home equity in the first quarter of 2019. The westlake financial el paso tx number marks an all-time high considering that measurement started in 2000, highlighting how large a source of wealth home equity is for retirement-age adults. House equity is just functional wealth if you offer and scale down or obtain against that equity.

Top Guidelines Of How Do Adjustable Rate Mortgages Work

A reverse home mortgage is a kind of loan for seniors ages 62 and older. Reverse mortgage loans allow property owners to transform their house equity into money earnings with no regular monthly home loan payments. Most reverse mortgages are federally insured, however be careful a spate of reverse mortgage scams that target elders. Reverse home loans can be a great financial choice for some, but a poor choice for others.

With a reverse home mortgage, instead of the property owner paying to the lending institution, the lender makes payments to the homeowner. The property owner gets to select how to get these payments (we'll describe the choices in the next area) and just pays interest on the proceeds received. The interest is rolled into the loan balance so the property owner doesn't pay anything in advance.

Over the loan's life, the house owner's debt boosts and house equity reduces. Similar to a forward mortgage, the house is the collateral for a reverse mortgage. When the property owner moves or dies, the proceeds from the house's sale go to the loan provider to pay back the reverse home mortgage's principal, interest, mortgage insurance coverage, and costs.

The Ultimate Guide To How Multi Famly Mortgages Work

In many cases, the successors may pick to pay off the mortgage so they can keep the house. Reverse home mortgage earnings are not taxable. While they might feel like earnings to the house owner, the IRS thinks about the cash to be a loan advance. There are three kinds of a reverse home loan.

The HECM represents practically all of the reverse home loans lenders provide on home values below $765,600 and is the type you're more than likely to get, so that's the type this short article will discuss. If your home is worth more, nevertheless, you can check out a jumbo reverse mortgage, also called a proprietary reverse home loan.

All about What Is The Catch With Reverse Mortgages

There are exceptions, though. If you're thinking about a reverse home loan, look around. Choose which kind of reverse home mortgage may be best for you. That may depend on what you want to do with the cash. Compare the alternatives, terms, and costs from various lending institutions. Discover as much as you can about reverse mortgages prior to you talk to a therapist or loan provider.

Here are some things to think about: If so, discover if you qualify for any inexpensive single function loans in your area. Staff at your regional Area Firm on Aging may understand about the programs in your location. Find the nearby agency on aging at eldercare. gov, or call 1-800-677-1116.

You may be able to borrow more money with an exclusive reverse home mortgage. However the more you borrow, the greater the costs you'll pay. You likewise might think about a HECM loan - how do adjustable rate mortgages work. A HECM therapist or a lending institution can help you compare these kinds of loans side by side, to see what you'll get and what it costs.

Indicators on How Do Mortgages Work You Should Know

While timeshare cancellation attorney the home loan insurance premium is normally the very same from loan provider to lending institution, a lot of loan costs including origination charges, rate of interest, closing costs, and maintenance charges vary amongst lenders. Ask a counselor or lending institution to discuss the Total Annual Loan Expense (TALC) rates: they reveal the projected yearly average expense of a reverse home loan, consisting of all the itemized costs.

Is a reverse mortgage right for you? Only you can choose what works for your circumstance. A counselor from an independent government-approved housing therapy firm can assist. However a salesperson isn't likely to be the very best guide for what works for you. This is particularly true if he or she imitates a reverse home mortgage is a solution for all your issues, presses you to take out a loan, or has ideas on how you can spend the cash from a reverse home mortgage.

If you choose you need house improvements, and you believe a reverse home loan is the way to pay for them, search before choosing a particular seller. Your home enhancement costs include not just the price of the work being done however also the expenses and charges you'll pay to get the reverse home loan.

Some Ideas on How Do Mortgages Work In Monopoly You Need To Know

Resist that pressure. If westlake financial el paso tx you buy those sort of financial products, you could lose the cash you get from your reverse mortgage. You don't need to buy any monetary items, services or investment to get a reverse home mortgage. In truth, in some circumstances, it's prohibited to need you to buy other items to get a reverse home loan - how does underwriting work for mortgages.

Stop and talk to a counselor or somebody you trust before you sign anything. A reverse home loan can be complicated, and isn't something to hurry into. The bottom line: If you don't understand the expense or features of a reverse home mortgage, leave. If you feel pressure or seriousness to finish the deal leave.

With the majority of reverse home mortgages, you have at least https://b3.zcubes.com/v.aspx?mid=5466885&title=getting-my-which-of-the-following-is-not-true-about-mortgages-to-work three company days after near to cancel the offer for any reason, without penalty. This is known as your right of "rescission." To cancel, you must notify the loan provider in composing. Send your letter by licensed mail, and request for a return invoice.

Rumored Buzz on How Mortgages Work

Keep copies of your correspondence and any enclosures. After you cancel, the lender has 20 days to return any cash you've spent for the financing. If you believe a scam, or that somebody included in the transaction may be breaking the law, let the counselor, lending institution, or loan servicer know.

Whether a reverse home loan is right for you is a huge concern. Think about all your choices. You might receive less expensive options. The following organizations have more details: 1-800-CALL-FHA (1-800-225-5342) 1-855- 411-CFPB (1-855-411-2372) 1-800-209-8085.

In a word, a reverse mortgage is a loan. A homeowner who is 62 or older and has significant house equity can obtain against the value of their home and get funds as a swelling amount, fixed monthly payment or line of credit. Unlike a forward mortgagethe type utilized to purchase a homea reverse home mortgage doesn't need the property owner to make any loan payments.

6 Simple Techniques For How Do Negative Interest Rate Mortgages Work

Federal regulations need lenders to structure the deal so the loan amount doesn't surpass the home's worth and the customer or customer's estate won't be delegated paying the distinction if the loan balance does become larger than the house's worth. One way this might happen is through a drop in the house's market worth; another is if the customer lives a long time.