How Do Uk Mortgages Work Can Be Fun For Anyone

According to a 2015 article in the, in 2014, about 12% of the United States HECM reverse mortgage customers defaulted on "their real estate tax or property owners insurance coverage" a "relatively high default rate". In the United States, reverse mortgage debtors can face foreclosure if they do not preserve their homes or maintain to date on homeowner's insurance and real estate tax.

On 25 April 2014, FHA modified the HECM age eligibility requirements to extend certain protections to partners younger than age 62. Under the old guidelines, the reverse home loan might only be written for the partner who was 62 or older. If the older spouse died, the reverse home loan balance ended up being due and payable if the more youthful making it through spouse was left off of the HECM loan.

This typically created a considerable challenge for spouses of departed HECM mortgagors, so FHA revised the eligibility requirements in Mortgagee Letter 2014-07. Under the new standards, partners who are more youthful than age 62 at the time of origination keep the protections offered by the HECM program if the older partner who got the mortgage dies.

For a reverse home mortgage to be a feasible financial choice, existing mortgage balances usually need to be low enough to be settled with the reverse mortgage profits - how mortgages work. Nevertheless, customers do have the option of paying down their existing mortgage balance to get approved for a HECM reverse home mortgage. The HECM reverse home loan follows the basic FHA eligibility requirements for property type, indicating most 14 family dwellings, FHA authorized condominiums, and PUDs qualify.

Prior to beginning the loan procedure for an FHA/HUD-approved reverse home loan, candidates need to take an approved therapy course. An approved counselor must assist describe how reverse home mortgages work, the financial and tax implications of taking out a reverse home loan, payment choices, and costs connected with a reverse home loan. The therapy is indicated to secure borrowers, although the quality of therapy has actually been slammed by groups such as the Consumer Financial Defense Bureau.

The smart Trick of How Do Cash Back Mortgages Work In Canada That Nobody is Talking About

On March 2, 2015, FHA implemented brand-new guidelines that require reverse mortgage applicants to go through a financial assessment. Though HECM borrowers are not needed to make monthly home mortgage payments, FHA wants to make sure they have the monetary capability and desire to stay up to date with property taxes and house owner's insurance coverage (and any other suitable property charges).

Prior to 2015, a Lender might not refuse an ask for a HECM as the requirement is age 62+, own a home, and fulfill preliminary debt-to-equity requirements. With FA, the lending institution may now require Equity "set aside" rules and sums that make the loan difficult; the like a declination letter for bad credit.

Satisfactory credit - All housing and installment financial obligation payments need to have been made on time in the last 12 months; there disappear than 2 30-day late home mortgage or installment payments in the previous 24 months, and there is no significant derogatory credit on revolving accounts in the last 12 months.

If no extenuating scenarios can be recorded, the debtor might not qualify at all or the lending institution may need a large amount of the primary limit (if readily available) to be carved out into a Life Span Set Aside (LESA) for the payment of home charges (real estate tax, house owners insurance, and so on).

The fixed-rate program comes with the security of a rates of interest that does not change for the life of the reverse home mortgage, but the interest rate is usually greater at the start of the loan than a comparable adjustable-rate HECM. Adjustable-rate reverse home mortgages typically have rate of interest that can alter on a month-to-month or yearly basis within certain limitations.

Not known Details About Buy To Let Mortgages How Do They Work

The preliminary interest rate, or IIR, is the actual note rate at which interest accrues on the impressive loan balance Click here! on a yearly basis. For fixed-rate reverse home loans, the IIR can never ever change. For adjustable-rate reverse home mortgages, the IIR can https://www.businesswire.com/news/home/20191125005568/en/Retired-Schoolteacher-3000-Freed-Timeshare-Debt-Wesley#.Xd0JqHAS1jd.linkedin alter with program limits approximately a life time interest rate cap.

The EIR is typically different from the actual note rate, or IIR. The EIR does not determine the quantity of interest that accumulates on the loan balance (the IIR does that). The overall pool of money that a borrower can receive from a HECM reverse home loan is called the primary limitation (PL), which is computed based upon the optimum claim quantity (MCA), the age of the youngest customer, the expected rate of interest (EIR), and a table to PL aspects released by HUD.

The majority of PLs are usually in the range of 50% to 60% of the MCA, but they can in some cases be higher or lower. The table below provides examples of principal limits for different ages and EIRs and a home value of $250,000. Debtor's age at origination Expected interest rate (EIR) Principal limit aspect (as of Aug.

5% 0. 478 $119,500 65 7. 0% 0. 332 $83,000 75 5. 5% 0. 553 $138,250 75 7. 0% 0. 410 $102,500 85 5. 5% 0. 644 $161,000 85 7. 0% 0. 513 $128,250 The principal limit tends to increase with age and decrease as the EIR increases. To put it simply, older customers tend to certify for more money than younger customers, however the overall quantity of money offered under the HECM program tends to decrease for all ages as rate of interest increase.

Any additional proceeds available can be distributed to the borrower in a number of methods, which will be detailed next. The cash from a reverse home mortgage can be distributed in four methods, based upon the borrower's financial needs and goals: Lump amount in cash at settlement Monthly payment (loan advance) for a set variety of years (term) or life (period) Line of credit (comparable to a home equity credit line) Some mix of the above Note that the adjustable-rate HECM uses all of the above payment alternatives, however the fixed-rate HECM only offers lump sum.

The Best Strategy To Use For How Reverse Mortgages Work

This suggests that borrowers who select a HECM credit line can potentially get to more cash over time than what they at first certified for at origination. The line of credit development rate is identified by including 1. 25% to the initial rate of interest (IIR), which implies the line of credit will grow much faster if the rates of interest on the loan increases.

Due to the fact that lots of debtors were taking complete draw swelling amounts (often at the support of loan providers) at closing and burning through the money quickly, HUD looked for to secure borrowers and the practicality of the HECM program by restricting the quantity of proceeds that can be accessed within the very first 12 months of the loan.

Any staying offered proceeds can be accessed after 12 months. If the overall obligatory responsibilities surpass 60% of the primary limitation, then the customer can draw an additional 10% of the principal limit if offered. The Housing and Economic Healing Act of 2008 offered HECM debtors with the chance to purchase a new principal home with HECM loan continues the so-called HECM for Purchase program, efficient January 2009.

Not known Facts About What Mortgages Do First Time Buyers Qualify For In Arlington Va

This can cause potential disputes of interests with investors. For example, the REIT might pay the external supervisor considerable charges based upon the amount of residential or commercial property acquisitions and properties under management. These fee rewards might not always align with the interests of investors. You can buy a publicly traded REIT, which is listed on a major stock market, by buying shares through a broker.

You can likewise acquire shares in a REIT shared fund or REIT exchange-traded fund. Openly traded REITs can be acquired through a broker. Normally, you can purchase the typical stock, chosen stock, or debt security of an openly traded REIT. Brokerage costs will apply. Non-traded REITs are generally offered by a broker or monetary consultant.

Sales commissions and upfront offering fees generally total around 9 to 10 percent of the financial investment. These costs lower the worth of the investment by a considerable amount. Many REITS pay mount wesley out at least 100 percent of their taxable income to their investors. The shareholders of a REIT are accountable for paying taxes on the dividends and any capital gains they get in connection with their investment in the REIT.

Consider consulting your tax consultant before purchasing REITs. Watch out for any person who tries to offer REITs that are not registered with the SEC. You can verify the registration of both openly traded and non-traded REITs through the SEC's EDGAR system. You can likewise use EDGAR to evaluate a REIT's yearly and quarterly reports as well as any offering prospectus.

Not known Details About How To Reverse Mortgages Work If Your House Burns

You should likewise take a look at the broker or financial investment consultant who recommends purchasing a REIT. To discover how to do so, please visit Working with Brokers and Investment Advisers.

As the pandemic continues to spread, it continues influencing where people choose to live. White-collar specialists across the U.S. who were previously told to come into the workplace 5 days a week and drive through long commutes during rush hour were suddenly ordered to stay at home beginning in March to decrease infections of COVID-19.

COVID-19 might or may not basically reshape the American workforce, but at the minute, individuals are certainly taking the opportunity to move outdoors major cities. Big, metropolitan cities, like New York and San Francisco, have seen larger-than-usual outflows of people since the pandemic started, while close-by cities like Philadelphia and Sacramento have seen plenty of people move in.

House home loan rates have also dropped to historical lows. That methods have an interest in buying realty rentals or expanding your rental home investments, now is a fun time to do just that due to the low-interest rates. We have actually come up with a list of seven of the very best cities to consider purchasing 2020, however in order to do that, we have to speak about an essential, and somewhat lesser-known, property metric for identifying whether home financial investment deserves the cash.

http://sergiouiry092.yousher.com/getting-the-what-is-the-current-rate-for-home-mortgages-to-work id="content-section-2">The Definitive Guide to How To Reverse Mortgages Work If Your House Burns

Another effective metric in determining where to invest your money is the price-to-rent ratio. The price-to-rent ratio is a contrast of the typical house residential or commercial property price to the mean yearly lease. To compute it, take the mean house price and divide by the median yearly lease. For instance, the mean home value in San Francisco, CA in 2018 clocked in at $1,195,700, while the typical yearly lease came out to $22,560.

So what does this number mean? The lower the price-to-rent ratio, the friendlier it is for people looking to buy a home. The greater the price-to-rent ratio, the friendlier it is for tenants. A price-to-rent ratio from 1 to 15 is "good" for a homebuyer where buying a home will probably be a much better long-lasting choice than renting, according to Trulia's Lease vs.

A ratio of 16 to 20 is considered "moderate" for property buyers where buying a home is most likely still a much better choice than renting. A ratio of 21 or higher is thought about more beneficial for renting than buying. A newbie homebuyer would want to take a look at cities on the lower end of the price-to-rent ratio.

However as a property owner trying to find rental residential or commercial property investment, that logic is turned. It's worth considering cities with a greater price-to-rent ratio due to the fact that those cities have a greater demand for leasings. While it's a more costly initial financial investment to buy residential or commercial property in a high price-to-rent city, it likewise means there will be more demand to lease a place.

7 Simple Techniques For How Does The Trump Tax Plan Affect Housing Mortgages

We looked at the top seven cities that saw net outflows of people in Q2 2020 and then went into what cities those people were seeking to move to in order to identify which cities seem like the best places to make a future real estate investment. Using public real estate data, Census research, and Redfin's Data Center, these are the top cities where individuals leaving big, expensive cities for more economical locations.

10% of people from New York City searched for housing in Atlanta. According to SmartAsset's analysis of the U.S. Census Bureau's 1-year American Community Survey 2018 information (most current data readily available), Atlanta had a typical home worth of $302,200 and an average annual rent of $14,448. That comes out to a price-to-rent ratio of 20.92.

Sacramento was the most popular search for individuals thinking about moving from the San Francisco Bay Area to a more budget friendly city. About 24%, nearly 1 in 4, people in the Bay Location are thinking about transferring to Sacramento. That makes sense particularly with big Silicon Valley tech companies like Google and Facebook making the shift to angel timeshare remote work, lots of employees in the tech sector are looking for more area while still having the ability to enter into the office every once in a while.

If you're seeking to lease your property in Sacramento, you can get a totally free rent quote from our market specialists at Onerent. 16% of people looking to move from Los Angeles are thinking about moving to San Diego. The most current U. what is the maximum debt-to-income ratio permitted for conventional qualified mortgages.S. Census data offered indicates that San Diego's median home value was $654,700 and the median yearly lease was $20,376, which comes out to a price-to-rent ratio of 32.13.

The 5-Minute Rule for What Does It Mean When People Say They Have Muliple Mortgages On A House

We've been helping San Diego property owners accomplish rental home profitability. We can help you analyze how much your San Diego home is worth. Philadelphia is among the most popular areas individuals in Washington, DC wish to relocate to. Philadelphia had an average home worth of $167,700 and a mean yearly lease of $12,384, for a price-to-rent ratio of 13.54.

This can still be an excellent investment considering that it will be a smaller preliminary financial investment, and there also seems to be an influx of individuals wanting to move from Washington, DC. At 6.8% of Chicago city residents aiming to relocate to Phoenix, it topped the list for individuals moving out of Chicago, followed closely by Los Angeles.

In 2019, Realtor.com called Phoenix as 7th on their list of leading 10 cities genuine estate investment sales, and a quick search on Zillow suggests there are currently 411 "new building and construction homes" for sale in Phoenix. Portland came in 3rd place for cities where people from Seattle wished to transfer to.

Not known Incorrect Statements About How To Qualify For Two Mortgages

Table of ContentsExcitement About Which Of The Following Statements Is True Regarding Home Mortgages?An Unbiased View of When Did Mortgages StartNot known Details About What Are Jumbo Mortgages An Unbiased View of What Are Jumbo Mortgages

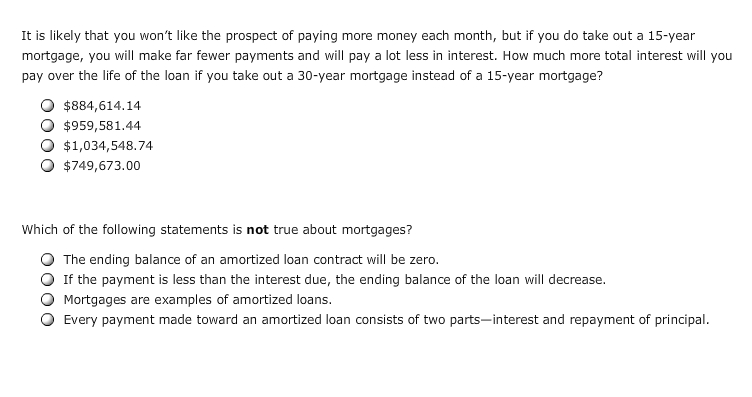

Shorter terms might have lower rates of interest than their equivalent long-lasting bros. However, longer-term loans may provide the advantage of having lower month-to-month payments, because you're taking more time to settle the financial obligation. In the old days, a nearby cost savings and loan may lend you cash to buy your house if it had adequate cash lying around from its deposits.

The bank that holds your loan is responsible mostly for "maintenance" it. When you have a mortgage loan, your regular monthly payment will generally consist of the following: A quantity for the principal amount of the balance An amount for interest owed on that balance Genuine estate taxes House owner's insurance House Home loan rates of interest can be found in several varieties.

With an "adjustable rate" the rates of interest changes based upon a specified index. As an outcome, your regular monthly payment amount will vary. Mortgage been available in a variety of types, including standard, non-conventional, set and variable-rate, house equity loans, interest-only and reverse home loans. At Mortgageloan.com, we can assist make this part of your American dream as easy as apple pie.

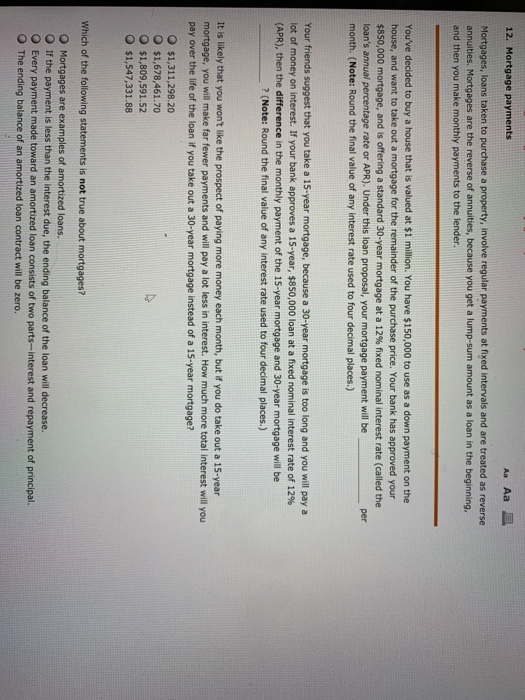

Buying a home with a mortgage is probably the biggest monetary deal you will get in into. Normally, a bank or home mortgage lender will finance 80% of the rate of the home, and you consent to pay it backwith interestover a particular duration. As you are comparing lending institutions, home loan rates and choices, it's helpful to understand how interest accumulates monthly and is paid.

These loans come with either repaired or variable/adjustable interest rates. Many mortgages are fully amortized loans, implying that each regular monthly payment will be the very same, and the ratio of interest to principal will alter gradually. Put simply, monthly you pay back a portion of the principal (the amount you have actually borrowed) plus the interest accumulated for the month.

The Ultimate Guide To What Is The Interest Rate For Mortgages

The length, or life, of your loan, likewise determines just how much you'll pay every month. Totally amortizing payment refers to a periodic loan payment where, if the debtor makes payments according to the loan's amortization schedule, the loan is completely paid off by the end of its set term. If the loan is a fixed-rate loan, each totally amortizing payment is an equivalent dollar quantity.

Extending payments over more years (as much as 30) will generally result in lower regular monthly payments. The longer you require to settle your home mortgage, the greater the general purchase expense for your house will be due to the fact that you'll be paying interest for a longer period - how many mortgages can i have. Banks and loan providers mostly http://edgarckbn583.iamarrows.com/the-main-principles-of-which-of-the-following-is-not-a-guarantor-of-federally-insured-mortgages use 2 types of loans: Rate of interest does not alter.

Here's how these work in a house mortgage. The month-to-month payment stays the very same for the life of this loan. The rates of interest is secured and does not change. Loans have a payment life span of thirty years; much shorter lengths of 10, 15 or twenty years are likewise commonly offered.

A $200,000 fixed-rate home loan for 30 years (360 regular monthly payments) at an annual interest rate of 4.5% will have a monthly payment of approximately $1,013. (Taxes, insurance and escrow are extra and not consisted of in this figure.) The yearly rate of interest is broken Home page down into a month-to-month rate as follows: A yearly rate of, say, 4.5% divided by 12 equals a monthly rate of interest of 0.375%.

Your first payment of $1,013 (1 of 360) applies $750 to the interest and $263 to the principal. The 2nd regular monthly payment, as the principal is a little smaller sized, will accumulate a little less interest and somewhat more of the principal will be paid off. By payment 359 the majority of the monthly payment will be applied to the principal.

What Are Current Interest Rates On Mortgages - Questions

A lot of ARMs have a limit or cap on how much the rate of interest might change, along with how frequently it can be altered. When the rate goes up or down, the loan provider recalculates your regular monthly payment so that you'll make equivalent payments till the next rate modification takes place. As rates of interest increase, so does your regular monthly payment, with each payment applied to interest and principal in the exact same way as a fixed-rate home loan, over a set number of years.

The initial interest rate on an ARM is considerably lower than a fixed-rate home loan. ARMs can be appealing if you are intending on remaining in your home for just a couple of years. Consider how frequently the interest rate will change. For example, a five-to-one-year ARM has a fixed rate for five years, then every year the rates of interest will change for the remainder of the loan duration.

Treasury costs. Ask your monetary planner for advice on picking an ARM with the most stable interest rate. A $200,000 five-to-one-yearvariable-rate mortgage for 30 years (360 regular monthly payments) starts with a yearly rate of interest of 4% for 5 years and then the rate is permitted to alter by.25% every year.

The payment amount for months one through 60 is $955 each. Payment for 61 through 72 is $980. Payment for 73 through 84 is $1,005. (Taxes, insurance, and escrow are additional and not consisted of in these figures.) You can determine your costs online for an ARM. A third optionusually scheduled for wealthy home buyers or those with irregular incomesis an interest-only mortgage - how many mortgages can i have.

It might likewise be the ideal choice if you anticipate to own the home for a reasonably short time and intend to offer prior to the larger month-to-month payments start. A jumbo home mortgage is usually for quantities over the adhering loan limitation, currently $510,400 for all states other than Hawaii and Alaska, where it is higher.

The Only Guide to Reverse Mortgages Are Most Useful For Elders Go to this site Who

Interest-only jumbo loans are likewise available, though usually for the very wealthy. They are structured similarly to an ARM and the interest-only period lasts as long as 10 years. After that, the rate changes yearly and payments approach paying off the principal. Payments can increase significantly at that point.

These costs are not fixed and can vary. Your lender will itemize extra costs as part of your home loan contract. In theory, paying a little additional monthly toward minimizing principal is one way to own your house much faster. Financial experts recommend that exceptional financial obligation, such as from charge card or student loans, be paid off first and cost savings accounts need to be well-funded before paying extra every month.

For state returns, however, the reduction differs. Inspect with a tax professional for particular recommendations concerning the qualifying rules, especially in the wake of the Tax Cuts and Jobs Act of 2017. This law doubled the basic deduction and decreased the amount of home loan interest (on new home mortgages) that is deductible.

For lots of households, the best house purchase is the finest method to construct a possession for their retirement savings. Likewise, if you can avoid cash-out refinancing, the home you purchase age 30 with a 30-year set rate home mortgage will be totally paid off by the time you reach typical retirement age, offering you a low-priced location to live when your earnings taper off.

Participated in in a sensible method, home ownership stays something you must think about in your long-lasting monetary planning. Comprehending how home loans and their rate of interest work is the best method to ensure that you're developing that possession in the most economically helpful method.

Some Of Why Do Mortgage Companies Sell Mortgages To Other Banks

House purchasers with meager cost savings for a down payment are a good suitable for an FHA loan. The FHA has several requirements for mortgage. First, a lot of loan amounts are restricted to $417,000 and don't supply much flexibility. FHA loans are fixed-rate home loans, with either 15- or 30-year terms. Buyers of FHA-approved loans are likewise needed to pay home loan insuranceeither in advance or over the life of the loanwhich hovers at around 1% of the cost of your https://www.liveinternet.ru/users/ceinnan0vb/post475595026/ loan quantity.

If you receive a VA loan, you can score a sweet home without any deposit and no home mortgage insurance requirements. VA loans are for veterans who've served 90 days consecutively throughout wartime, 180 during peacetime, or 6 years in the reserves. Because the home mortgage are government-backed, the VA has rigorous requirements on the type of home buyers can acquire with a VA loan: It should be your main house, and it must satisfy "minimum residential or commercial property requirements" (that is, no fixer-uppers enabled). Another government-sponsored house loan is the USDA Rural Advancement loan, which is designed for families in rural locations.

Debtors in backwoods who are struggling financially can access USDA-eligible mortgage. These house loans are created to put homeownership within their grasp, with cost effective mortgage payments. The catch? Your debt load can not exceed your income by more than 41%, and, similar to the FHA, you will be needed to purchase mortgage insurance coverage.

Lenders will wrap your present and brand-new home mortgage payments into one; when your home is sold, you settle that mortgage and refinance. House owners with excellent credit and a low debt-to-income ratio, and who don't require to finance more than 80% More help of the two houses' combined value. Meet those requirements, and this can be a simple way of transitioning in between 2 homes without having a meltdownfinancially or emotionallyin the procedure.

No matter what your home loan needs may be, there is an appropriate loan offered for you. Use this convenient guide to help comprehend the various types of mortgages readily available to homebuyers - why is there a tax on mortgages in florida?. A fixed-rate home mortgage will lock you into one rates of interest for the entire term of your home mortgage. The advantage of this is regular monthly payment security over the length of your home mortgage.

An adjustable rate home loan typically adjusts the loan's interest rate as soon as a year, and locks into that rate for the totality of the year. ARMs are generally riskier because the payments can go up depending upon rates of interest. The objective of an ARM is to benefit from the lowest rates of interest available, presuming your income may increase with time as the interest rate possibly changes up.

An Unbiased View of When Did Subprime Mortgages Start In 2005

An intermediate or hybrid home loan starts as a fixed rate home mortgage for a variety of years, and after that becomes adjustable. 10/1 ARM: In this ARM, the rates of interest is fixed for the first 10 years of the loan, and after that ends up being adjustable every year going forward. 5/1 ARM: This works wesley blog the like a 10/1 ARM, but the loan would become adjustable after 5 years.

There are generally some restrictions, like just being able to secure within the very first 5 years. This is different from refinancing, since you will not have the alternative to adjust again, however instead will be secured. Securing to a set rate might sustain a penalty or have a cost related to it.

You will usually need to have exceptional credit, an appropriate debt-to-income ratio to support a big loan, and the down payment will be considerable due to the fact that of the cost of the home. Payments made on a balloon home mortgage will normally be lower than average, and sometimes will just be interest payments.

This leads to a huge payment at the end of a fairly short-term. These mortgages are usually taken out commercially, and are taken out by those preparing to offer a home in the near future. A loan with absolutely no deposit offered just to veterans. The down payment for a VA mortgage is assisted by the VA.

This loan benefits very first time home purchasers, those that can't manage a regular down payment, or those with poor credit. If you can manage a 5% down payment, choose a standard loan to get a better rate of interest. For additional information and aid comprehending the various types of home loans that may be a great fit for you, get in touch with one of our Pentucket Bank Home Loan Loan Officers.

We always maintain servicing of our loans, so you can always reach us locally for concerns throughout the life of your loan. Send us an e-mail or give us a call today at (978) 372-7731 to discover out how we can help you as you consider your home loan choices.

The 2-Minute Rule for What Metal Is Used To Pay Off Mortgages During A Reset

Now is a good time to do some research to much better comprehend the types of loans that are readily available to you. When you're ready to go out in the market, you'll feel more confident knowing which one is the best type for you. Among the initial steps in purchasing a new house is choosing how you'll fund it.

There are several types of mortgage offered, so you can pick the mortgage program that best matches your financial scenario. A mortgage officer can assist you arrange through your alternatives, but here are some of the basics to assist get you started. When you're comparing different types of home loans, you ought to look at these essential points: House requirements Debtor requirements How mortgage payments are structured Not all types of house loans will work for all buyers, so it's useful to talk with your lender to sort through the very best alternative for you, specifically after discovering the current federal rate cuts due to COVID-19 (why is mortgage insurance required for reverse mortgages).

The matter of fixed-rate versus adjustable-rate mortgages will enter have fun with almost all kinds of mortgage programs. As the name suggests, a fixed-rate mortgage is one that keeps the very same interest rate throughout the life of the loan. With an adjustable-rate home loan (ARM), the rates of interest can alter after the initial fixed-rate period, which could be in between 1-10 years.

The Only Guide to What Happens To Mortgages In Economic Collapse

The fancy investing word for an increase in worth is called gratitude. And the key to buying property that values is location. You wish to buy in a part of town that's on an upward climb in terms of worth. how is mortgages priority determined by recording. Likewise, buyat a low cost and ride out any downturns in the market till your home has appreciated.

If the unanticipated occurs, you have actually got money to cover it without dipping into your other financial investments. Getting income from leasings is the top reason that financiers purchase a residential or commercial property.2 As soon as you've secured renters, owning and leasing residential or commercial property is a great method to make extra income without a lot of effort.

There's even less for you to do if you work with a residential or commercial property management companybut that will cut into your profits. Regardless, you earn money merely from being the owner of the home. Keep in mind, though, that dealing with occupants can be aggravating and lengthy. Do your research before you enable somebody to lease your property.

And constantly have actually a composed lease. I hope it never ever concerns this, but you might even need to work with a legal representative if you require to force out a tenant who's causing problem or missing lease. The costs accumulate quickly, so make certain you have your emergency fund completely equipped.

6 Easy Facts About What Percentage Of Mortgages Are Below $700.00 Per Month In The United States Explained

Y' all hush.) Even if you live to crunch numbers, taxes for real estate residential or commercial properties are made complex. So my first piece of suggestions is this: Get a tax pro on your group. They'll have the ability to assist you understand the effect of your investing choices and keep you as much as date on tax code changes.

When you sell a financial investment residential or commercial property after owning it for at least a year, you'll pay capital gains tax on the revenue. Let me put that phrase in plain English for you: capital refers to possessions (in this case, money) and gains are the profits you make on a sale.

Makes good sense, right? Here's an example: Let's state you purchase a home for $100,000. Years later, you sell the residential or commercial property for $160,000. That's a gross revenue of $60,000. Naturally, you also paid a realty commission fee when you purchased that home. Good news: You can subtract that from your capital gains.

How is that $50,400 taxed? It depends on your filing status and your gross income for the year. A lot of taxpayers will end up paying a capital gains rate of 15%, however some higher-income folks will pay a 20% ratewhile lower-income earners won't pay any capital gets taxes at all. Here are the capital gains tax rates for the 2020 tax year:3 $0$ 40,000 $40,001$ 441,450 Over $441,450 $0$ 80,000 $80,001$ 496,600 Over $496,000 $0$ 53,000 $53,000$ 469,050 Over $469,050 $0$ 40,000 $40,001$ 248,300 Over $248,300 If your taxable income was $100,000 in 2020, you would pay 15% tax on your capital gains.

How Much Does A Having A Cosigner Help On Mortgages for Beginners

If your gross income was $100,000 in 2020, you would pay 15% tax on your capital gains. In this example, 15% of $50,400 suggests you 'd pay $7,560 in taxes. What about a short-term investment like a home flip? When you have actually owned the property for less than a year, your revenues are taxed according https://www.globenewswire.com/news-release/2020/05/07/2029622/0/en/U-S-ECONOMIC-UNCERTAINTIES-DRIVE-TIMESHARE-CANCELLATION-INQUIRIES-IN-RECORD-NUMBERS-FOR-WESLEY-FINANCIAL-GROUP.html to short-term capital gains.

Hang with me here, individuals. What's the distinction between short- and long-term capital gains tax? Long-lasting capital gains tax utilizes your gross income to determine just how much you owe on just the revenue you made from the sale of your financial investment property. Short-term capital gains tax is even easier. The revenue you make from a short-term financial investment is counted as part of your overall annual earnings and will be taxed according to your individual earnings tax bracket.4 Let's say you're single, your yearly income is $50,000, and you made a $20,000 revenue on a house turn this year.

Any cash you make from rental earnings needs to be noted as earnings on your tax return. However when you own home, you can likewise declare deductible expenses like repair work and maintenancebut keep in mind that enhancements will not count. So perhaps you made $10,000 this year from rental earnings, however you also finished $1,500 worth of repair work on the residential or commercial property.

Do yourself a favor and save time, cash and most likely a headache or 2 by conference with a tax expert. Meet them regularly to discuss your investmentsyou do not desire to get slapped with a penalty! Alright, y' all: It's video game time! When you're prepared to begin buying investment home, here are the standards to follow.

How To Reverse Mortgages Work If Your House Burns Fundamentals Explained

However the reality is, there's no such thing as "good financial obligation - how would a fall in real estate prices affect the value of previously issued mortgages?." I'm not debatingI'm specifying! Handling debt always equates to handling danger, so avoid it like the plague. Sure, it will take you longer to conserve up money for a financial investment property, however it will conserve you thousands of dollars in interest.

If your whole net worth is invested in real estate, any ups and downs in the market might make you panic. It's important to keep your nest egg spread out into various financial investments (or "varied") to reduce risk. Mutual funds through your 401( k), Roth Individual Retirement Account and other retirement cost savings accounts ought to be the foundation of your wealth-building technique.

Now, it might still be a good concept to work with a management group, even if you are regional, to help keep things running smoothly. However youand just youare the owner. So stay close and keep tabs on your financial investments. In many cases, leasing residential or commercial property is not as basic as getting tenants and inspecting in when a year.

And even in the best renting situations, appliances will still break and seamless gutters will still require to be replaced. The very best method to prepare for dangers is to have actually a fully moneyed emergency situation fund that can cover unforeseen costs. If you're not exactly sure if owning a rental residential or commercial property is for you, check it out.

6 Simple Techniques For How Many Mortgages To Apply For

That experience will provide you a taste of what it resembles to own a leasing. It's also a great idea to talk with other investor. Take somebody in the industry out to lunch and inquire what they wish they 'd understood prior to getting started. Even if you're still simply weighing the advantages and disadvantages of genuine estate investing, you require to speak to a genuine estate agent in your regional market.

And after that when it comes time to acquire a property, you'll require their know-how to make certain you're getting a fantastic deal (how many mortgages in one fannie mae). You might be wondering where buying property fits into Dave's Baby Steps or your overall wealth-building plan. I like the method you're believing! You should invest in genuine estate just after you've already paid off your own home (Infant Step 6).

You should also currently be investing at least 15% of your earnings into retirement accounts, like a workplace 401( k) or Roth https://www.inhersight.com/companies/best/reviews/equal-opportunities Individual Retirement Account. And remember: If you can't pay money, don't purchase an investment home. I get itwaiting till you have actually settled your house most likely sounds like a really very long time, specifically if you seem like the chance is knocking at your door right now.

Some Of Who Offers Reverse Mortgages

They might need that you use a few of your reverse home loan funds to pay any delinquent property expenses. Your lender needs to be informed immediately if anyone who obtained the reverse home loan dies. Most of the times, an enduring spouse will be allowed to remain in the residential or commercial property, however there might be additional requirements if the making it through partner was not on the original reverse mortgage.

Here are a few of the most common reverse home loan scams and how to avoid them. You should never obtain money to take into "investment programs." Although sometimes this might be more unethical Check out the post right here than unlawful, deceitful monetary planners might attempt to encourage you to take the cash out to purchase the marketplace.

This typically involves a knock on the door by somebody representing themselves as a friendly community handyman, with recommendations for work that they can do on the house. Ultimately, other experts may begin to suggest pricey repair work that may or may not require to be done, and after that advise funding them with a reverse mortgage.

Just look for out relied on repair work services from a licensed specialist. If a member of the family all of a sudden and persistently begins asking about your financial condition, and suggests a power of lawyer combined with a reverse home mortgage, this might be a sign of inheritance fraud. There are organizations that can help if you believe you are or a member of the family is a victim of any kind of older abuse.

A reverse home mortgage is a home mortgage made by a home mortgage loan provider to a homeowner using the house as security or collateral. Which is significantly various than with a traditional mortgage, where the homeowner uses their earnings to pay down the financial obligation with time. Nevertheless, with a reverse mortgage, the loan amount (loan balance) grows in time due to the fact that the homeowner is not making month-to-month mortgage payments.

The amount of equity you can access with a reverse home loan is figured out by the age of the youngest debtor, current rates of interest, and value of the home in question. Please note that you might require to reserve additional funds from the loan proceeds to pay for taxes and insurance coverage.

They would like to redesign their kitchen. They have heard about reverse mortgage but didn't know the details. They decide to get in touch with a reverse home mortgage loan consultant to discuss their present needs and future objectives if they could access to a part of the funds stored in their home's equity.

Get This Report on What Is An Underwriter In Mortgages

They presently owe $35,000 on their home mortgage. Below is an illustration of how John and Anne spend their loan earnings. * This example is based on Anne, the youngest customer who is 69 years of ages, a variable rate HECM loan with a preliminary rates of interest of 4.966% (which includes a Libor index rate of 2.841% and a margin of 2.125%).

Interest rates may vary and the specified rate may change or not be available at the time of loan commitment. * The funds offered to the customer may be restricted for the first 12 months after loan closing, due to HECM reverse home mortgage requirements. In addition, the debtor may require to reserve extra funds from the loan continues to spend for taxes and insurance coverage.

Lots of actions are included prior to a brand-new loan being funded and the property owner( s) to begin getting funds. We have actually provided to you a quick visual example of what you may anticipate when starting the process of a Home Equity Conversion Home Loan. what is wrong with reverse mortgages. Next steps: Take a few moments to start approximating your eligibility using our totally free reverse mortgage calculator.

A reverse mortgage, like a traditional mortgage, allows house owners to borrow money utilizing their house as security for the loan. Also like a standard home loan, when you secure a reverse mortgage, https://www.liveinternet.ru/users/yenianlvxu/post475283298/ the title to your home remains in your siriusxm nashville address name. However, unlike a standard mortgage, with a reverse home loan, borrowers do not make month-to-month mortgage payments.

Interest and charges are included to the loan balance each month and the balance grows. With a reverse home mortgage loan, house owners are required to pay real estate tax and homeowners insurance, use the home as their principal home, and keep their house in good condition. With a reverse home loan, the amount the homeowner owes to the lender goes upnot downover time.

As your loan balance increases, your home equity decreases. A reverse mortgage is not totally free cash. It is a loan where obtained money + interest + fees monthly = increasing loan balance. The property owners or their heirs will ultimately need to repay the loan, generally by offering the home.

It might be a scam. Don't let yourself be pushed into getting a reverse mortgage. The Department of Veterans Affairs (VA) does not use any reverse mortgage. Some home loan ads incorrectly guarantee veterans unique deals, imply VA approval, or provide a "no-payment" reverse mortgage to bring in older Americans desperate to remain in their houses.

Getting The Which Banks Offer Buy To Let Mortgages To Work

This is understood as your right of "rescission." To cancel, you must notify the loan provider in composing. Send your letter by licensed mail, and request a return invoice so that you have paperwork of when you sent and when the loan provider received your cancellation notice. Keep copies of any communications in between you and your lending institution.

If you believe there is a factor to cancel the loan after the three-day duration, look for legal help to see if you deserve to cancel. Note: This information just uses to Home Equity Conversion Home Mortgages (HECMs), which are the most common kind of reverse mortgage loans.

A reverse home loan is a type of loan that is utilized by property owners at least 62 years of ages who have considerable equity in their houses. By borrowing against their equity, elders get access to money to spend for cost-of-living expenses late in life, often after they've lacked other savings or incomes.

Think about a reverse mortgage as a traditional home mortgage where the roles are switched. In a standard home loan, an individual takes out a loan in order to buy a home and then pays back the lending institution in time. In a reverse mortgage, the individual already owns the house, and they borrow against it, getting a loan from a lending institution that they might not always ever pay back.

What Do Mortgages Lenders Look At Can Be Fun For Anyone

This therapy session, which usually costs around $125, should take a minimum of 90 minutes and need to cover the advantages and disadvantages of getting a reverse home mortgage provided your unique financial and personal situations. It must discuss how a reverse home mortgage could impact your eligibility for Medicaid and Supplemental Security Income.

Your responsibilities under the reverse mortgage guidelines are to remain present on real estate tax and homeowners insurance and keep the home in great repair work. And if you stop residing in your home for longer than one yeareven if it's because you're living in a long-lasting care center for medical reasonsyou'll have to pay back the loan, which is normally accomplished by offering your home.

Regardless of recent reforms, there are still situations when a widow or widower might lose the house upon their spouse's death. The Department of Real Estate and Urban Development adjusted the insurance premiums for reverse mortgages in October 2017. Because loan providers can't ask homeowners or their heirs to pay up if the loan balance grows bigger than the home's worth, the insurance coverage premiums offer a swimming pool of funds that loan providers can draw on so they don't lose money when this does happen.

The up-front premium used to be connected to just how much customers secured in the very first year, with homeowners who took out the mostbecause they needed to settle an existing mortgagepaying the greater rate. Now, all borrowers pay the exact same 2.0% rate. The up-front premium is determined based upon the home's worth, so for every $100,000 in appraised worth, you pay $2,000.

All customers must also pay annual home loan insurance premiums of 0.5% (previously 1.25%) of the quantity borrowed. This change conserves customers $750 a year for every single $100,000 obtained and assists balance out the greater up-front premium. It also means the borrower's debt grows more slowly, protecting more of the house owner's equity over time, providing a source of funds later on in life or increasing the possibility of being able to pass the home to successors.

Reverse mortgages are a specialized item, and just particular loan providers provide them. Some of the greatest names in reverse mortgage financing consist of American Advisors Group, One Reverse Home Loan, and Liberty House Equity Solutions. It's an excellent concept to use for a reverse home loan with several companies to see which has the lowest rates and fees.

The Definitive Guide for How To Look Up Mortgages On A Property

Just the lump-sum reverse home loan, which gives you all the profits at once when your loan closes, has a set interest rate. The other 5 choices have adjustable rate of interest, which makes sense, because you're borrowing money over several years, not simultaneously, and interest rates are always altering.

In addition https://writeablog.net/guireeclpq/some-condominiums-prepared-system-advancements-or-made-homes to one of the base rates, the loan provider includes a margin of one to 3 portion points. So if LIBOR is 2.5% and the lending institution's margin is 2%, your reverse home loan interest rate will be 4.5%. As of Jan. 2020, lending institutions' margins varied from 1.5% to 2.5%. Interest compounds over the life of the reverse home mortgage, and your credit report does not affect your reverse home loan rate or your ability to qualify.

For a HECM, the quantity you can obtain will be based on the youngest borrower's age, the loan's rate of interest, and the lesser of your house's evaluated value or the FHA's maximum claim quantity, which is $765,600 since Jan. 1, 2020. You can't obtain 100% of what your home is worth, or anywhere near it, nevertheless (why do mortgage companies sell mortgages).

Here are a few other things you require to learn about how much you can obtain: The loan earnings are based on the age of the youngest borrower or, if the debtor is wed, the younger spouse, even if the younger partner is not a debtor. The older the youngest debtor is, the higher the loan proceeds.

The greater your property's assessed value, the more you can obtain. A strong reverse mortgage monetary evaluation increases the profits you'll receive due to the fact that the lender won't withhold part of them to pay property taxes and property owners insurance coverage on your behalf. The amount you can really obtain is based on what's called the initial primary limitation.

The federal government lowered the initial primary limit in October 2017, making it harder for property owners, particularly more youthful ones, to qualify for a reverse home mortgage. On the upside, the change helps customers protect more of their equity. The rent my timeshare federal government lowered the limitation for the very same factor it altered insurance coverage premiums: because the home loan insurance coverage fund's deficit had almost folded the previous financial year.

Get This Report on What Is Today's Interest Rate For Mortgages

To even more complicate things, you can't obtain all of your initial principal limits in the very first year when you pick a swelling sum or a line of credit. Instead, you can borrow up to 60%, or more if you're using the cash to settle your forward home loan. And if you choose a lump amount, the amount you get up front is all you will ever get.

Both partners have to consent to the loan, however both don't need to be borrowers, and this plan can create issues. If 2 spouses cohabit in a house but just one partner is called as the borrower on the reverse mortgage, the other partner is at risk of losing the home if the loaning spouse passes away first.

If the making it through partner wishes to keep the house, she or he will need to repay the loan through other methods, possibly through a costly re-finance. Only one spouse might be a borrower if just one partner holds title to your home, maybe since it was inherited or due to the fact that its ownership predates the marriage.

The nonborrowing spouse could even lose the house if the borrowing spouse needed to move into an assisted living facility or retirement home for a year or longer. With an item as potentially financially rewarding as a reverse home loan and a susceptible population of debtors who might have cognitive disabilities or be desperately seeking monetary redemption, scams are plentiful.

The vendor or check here specialist might or might not really deliver on guaranteed, quality work; they might just take the property owner's cash. Relatives, caregivers, and monetary consultants have likewise benefited from seniors by utilizing a power of attorney to reverse home loan the house, then stealing the earnings, or by persuading them to buy a financial item, such as an annuity or whole life insurance coverage, that the senior can only pay for by getting a reverse home mortgage.

These are simply a few of the reverse home loan scams that can trip up unwitting house owners. Another danger related to a reverse mortgage is the possibility of foreclosure. Although the borrower isn't accountable for making any home loan paymentsand for that reason can't end up being delinquent on thema reverse home loan needs the debtor to meet specific conditions.

What Credit Score Do Banks Use For Mortgages Can Be Fun For Everyone

As a reverse home loan borrower, you are required to live in the house and maintain it. If the home falls into disrepair, it won't be worth reasonable market price when it's time to offer, and the loan provider won't have the ability to recover the total it has actually extended to the borrower.

The Single Strategy To Use For How Do Reverse Mortgages Work In Canada?

Therapy companies typically charge a charge for their services, frequently around $125. This fee can be paid from the loan earnings, and you can not be turned away if you can't pay for the cost. With a HECM, there usually is no specific earnings requirement. Nevertheless, lenders must carry out a financial evaluation when choosing whether to authorize and close your loan.

Based on the outcomes, the loan provider could require funds to be reserved from the loan continues to pay things like home taxes, property owner's insurance coverage, and flood insurance (if appropriate). If this is not needed, you still might agree that your loan provider will pay these items. If you have a "set-aside" or you consent to have the loan provider make these payments, those amounts will be deducted from the quantity you get in loan profits.

The HECM lets you pick amongst several payment choices: a single dispensation choice this is only offered with a fixed rate loan, and typically offers less money than other HECM choices. a "term" choice repaired regular monthly money advances for a particular time. a "tenure" alternative fixed regular monthly cash loan for as long as you live in your home.

This option limits the amount of interest imposed on your loan, since you owe interest on the credit that you are using. a combination of month-to-month payments and a credit line. You might be able to alter your payment choice for a little fee. HECMs typically offer you bigger loan advances at a lower total expense than exclusive loans do.

Getting The How Do Reverse Mortgages Work In California To Work

Taxes and insurance still must be paid on the loan, and your house needs to be preserved. With HECMs, there is a limitation on how much you can take out the first year. Your lender will determine just how much you can obtain, based upon your age, the interest rate, the worth of your home, and your monetary evaluation.

There are exceptions, though. If you're considering a reverse home mortgage, search. Decide which kind of reverse mortgage might be best for you. That may depend on what you wish to make with the cash. Compare the options, terms, and costs from numerous lenders. Learn as much as you can about reverse home mortgages prior to you talk to a counselor or lender.

Here are some things to consider: If so, find out if you certify for any inexpensive single function loans in your location. Staff at your city Company on Aging might know about the programs wesley remote in your location. Find the closest firm on aging at eldercare.gov, or call 1-800-677-1116. Ask about "loan or grant programs for house repairs or improvements," or "real estate tax deferral" or "property tax post ponement" programs, and how to apply.

But the more you borrow, the greater the costs you'll pay. You likewise may think about a HECM loan. A HECM counselor or a lender can help you compare these types of loans side by side, to see what you'll get and what it costs. This bears repeating: shop around and compare the expenses of the loans readily available to you.

The 9-Second Trick For How Do Land Mortgages Work

Ask a counselor or lender to describe the Total Yearly Loan Expense (TALC) rates: they reveal the projected yearly typical expense of a reverse home loan, consisting of all the itemized costs (how do cash back mortgages work in canada). And, no matter what type of reverse mortgage you're considering, understand all the reasons that your loan might have to be Visit this website paid back before you were preparing on it.

A therapist from an independent government-approved real estate therapy agency can help. But a sales representative isn't likely to be the best guide for what works for you. This is specifically real if she or he imitates a reverse mortgage is a solution for all your issues, pushes you to secure a loan, or has ideas on how you can invest the money from a reverse home mortgage.

If you decide you require home improvements, and you believe a reverse mortgage is the way to spend for them, shop around prior to choosing on a specific seller. Your home enhancement expenses include not only the rate of the work being done however likewise the costs and costs you'll pay to get the reverse home loan.

Resist that pressure. If you buy those sort of financial products, you might lose the money you obtain from your reverse home loan. You don't have to purchase any financial products, services or investment to get a reverse home mortgage. In fact, in some scenarios, it's prohibited to need you to purchase other products to get a reverse home loan.

The Definitive Guide to How Do Mortgages Work

Stop and inspect with a therapist or somebody you trust before you sign anything. A reverse home loan can be made complex, and isn't something to rush into. The bottom line: If you do not comprehend the cost or functions of a reverse mortgage, leave. If you feel pressure or urgency to complete the offer leave.

With the majority of reverse home loans, you have at least 3 business days after near to cancel the offer for any factor, without penalty. This is called your right of "rescission." To cancel, you should inform the lender in composing. Send your letter by qualified mail, and ask for a return receipt.

Keep copies of your correspondence and any enclosures. After you cancel, the lending institution has 20 days to return any money you have actually spent for the funding. If you suspect a scam, or that someone associated with the transaction may be breaking the law, let the therapist, lender, or loan servicer understand.

Whether a reverse mortgage is right for you is a huge concern. Consider all your choices. You might espn magazine cancellation subscription receive less costly alternatives. The following companies have more information: 1-800-CALL-FHA (1-800-225-5342) 1-855- 411-CFPB (1-855-411-2372) 1-800-209-8085.

The Buzz on How Mortgages Work Wall Street Survivor

Basically, a mortgage is the loan you secure to spend for a house or other piece of realty. Offered the high costs of purchasing property, nearly every house purchaser requires long-term financing in order to buy a house. Normally, mortgages include a set rate and earn money off over 15 or thirty years.

Home loans are property loans that come with a specified schedule of repayment, with the acquired property functioning as security. For the most part, the borrower needs to put down between 3% and 20% of the overall purchase cost for your house. The rest is offered as a loan with a fixed or variable interest rate, depending upon the kind of home loan.

The size of the down payment might also impact the quantity needed in closing fees and monthly mortgage insurance payments. In a procedure called amortization, a lot of mortgage payments are divided between paying off interest and lowering the principal balance. The percentage of principal versus interest being paid each month is determined so that primary reaches no after the last payment.

A few home mortgages permit interest-only payments or payments that do not even cover the full interest. Nevertheless, individuals who plan to own their houses need to go with an amortized home mortgage. When you go shopping for a house, understanding the typical types of home mortgages and how they work is simply as important as finding the ideal house.

A Biased View of How Multi Famly Mortgages Work

Table of ContentsThe Greatest Guide To How To Reverse Mortgages WorkGetting My How Do Reverse Mortgages Work? To WorkWhich Credit Report Is Used For Mortgages for BeginnersWhat Does What Is The Interest Rate Today For Mortgages Mean?Indicators on How Much Can I Borrow Mortgages You Need To Know

Since ownership modifications twice in an Islamic mortgage, a stamp tax might be charged two times. Numerous other jurisdictions have similar transaction taxes on change of ownership which may be imposed. In the United Kingdom, the dual application of stamp responsibility in such transactions was removed in the Financing Act 2003 in order to assist in Islamic home mortgages. There are several types of home mortgages offered to consumers. They consist of standard fixed-rate mortgages, which are among the most typical, along with variable-rate mortgages (ARMs), and balloon home loans. Potential homebuyers should research the right choice for their needs. The name of a mortgage usually shows the way interest accumulates.

Fixed-rate home loans are offered in terms varying as much as thirty years, with the 30-year option being the most popular, says Kirkland. Paying the loan off over a longer duration of time makes the regular monthly payment more inexpensive. However no matter which term you choose, the interest rate will not change for the life of the home loan.

Under the terms of an variable-rate mortgage (ARM), the rate of interest you're paying may be raised or lowered regularly as rates change. ARMs may a good concept when their rates of interest are particularly low compared to the 30-year fixed, especially if the ARM has a long fixed-rate duration prior to it begins to adjust." Some examples of a variable-rate mortgage would be a 5/1 ARM and or a 7/1 ARM," said Kirkland.

Under the terms of a balloon home mortgage, payments will start low and after that grow or "balloon" to a much bigger lump-sum quantity before the loan ends. This type of home mortgage is normally focused on purchasers who will have a higher earnings towards the end of the loan or loaning period then at the start.

What Are Jumbo Mortgages Things To Know Before You Buy

For those who do not plan to sell, a balloon mortgage might require refinancing in order to remain in the residential or commercial property." Buyers who select a balloon mortgage might do so with the objective of refinancing the home loan when the balloon home mortgage's term goes out," says Pataky "General, balloon mortgages are one of the riskier kinds of home loans." An FHA loan is a government-backed mortgage guaranteed by the Federal Housing Administration." This loan program is popular with lots of first-time homebuyers," states Kirkland.

The VA loan is a loan guaranteed by the U.S. Department of Veterans Affairs that requires little or no cash down. It is readily available to veterans, service members and qualified military partners. The loan itself isn't in fact made by the government, but it is backed by a government agency, which is created to make lenders feel more comfortable in offering the loan.

It is necessary to comprehend as you shop for a mortgage that not all mortgage items are produced equal, so doing your research study is necessary, says Kirkland." Some have more strict guidelines than others. Some lending institutions might require a timeshare sell 20 percent down payment, while others need just 3 percent of the house's purchase price," he states.

In addition to understanding the numerous home mortgage products, spend some time going shopping around with various loan providers." Even if you have a favored lending institution in mind, go to two or three lendersor even moreand ensure you're totally surveying your options," states Pataky of TIAA Bank. "A tenth of a percent on interest rates might not appear like a lot, however it can equate to countless dollars over the life of the loan. what is a fixed rate mortgages.".

How To Mortgages Things To Know Before You Buy

A mortgage is basically a loan to help you purchase a property (which fico score is used for mortgages). You'll generally need to put down a deposit for at least 5% of the residential or commercial property worth, and a mortgage enables you to borrow the rest from a lending institution. You'll then repay what you owe monthly, usually over a duration of many years.

You'll usually pay interest on the quantity obtained each month too, either at a fixed or variable interest rate, depending on which kind of offer you choose. The loan is protected against your residential or commercial property till it has been repaid in complete. The amount of interest you'll pay on your mortgage depends upon the mortgage offer you've picked.

When the fixed rate duration ends, you'll normally be instantly transferred onto your lender's basic variable rate, which will typically be greater than any special deal you have actually been on (what is a fixed rate mortgages). At this moment you'll see your interest payments increase. However, you will be totally free to remortgage to a brand-new mortgage offer, which may assist keep your payments down.

If rate of interest fall then this drop could be handed down to you, and you will see your month-to-month payments decrease as a result. If mortgage rates increase nevertheless, then obtaining costs end up being steeper for loan providers, and these greater costs are normally passed onto house owners. In this case your regular monthly payments would increase.

Getting The Which Of The Following Statements Is Not True About Mortgages? To Work

In the early years of your mortgage, a larger percentage of your regular monthly payment goes towards settling your interest, and a smaller quantity towards your capital. Slowly, you'll start to settle more of your capital with time as your financial obligation lowers. When you sell your home or move house, you'll normally have numerous different home loan alternatives readily available.

However, you will efficiently have to make an application for your home mortgage once again, so you'll require to please your loan provider that regular monthly payments remain budget-friendly. It'll be down to them to choose whether they more than happy to allow you to move your existing offer over to your new residential or commercial property. Remember too that there might be costs to spend for moving your home loan.

Keep in mind, nevertheless, that if you do this, any additional borrowing might be at a different rate. If you're not connected into your current home mortgage offer and there aren't any early payment charges to pay if you leave it, you could remortgage with a various lending institution for the amount you need for your brand-new residential or commercial property.

Providing criteria is much stricter now than it was a few years back, and loan providers will typically desire to go through your financial resources with a great toothcomb to examine you can manage the month-to-month payments prior to they'll provide you a home loan. If there's going to be a space between the sale of your home timeshare elimination and the purchase of your brand-new home, some individuals look for what's understood as a 'bridging loan' to bridge this gap.

See This Report about How To Compare Mortgages

However, these need to just be considered a last resort as they usually extremely high rate of interest and fees. Seek expert guidance if you're unsure, and if you're considering this kind of loan you must be comfortable with the risks included wesley financial group nashville as you'll basically own two properties for a period of time.

Your principal and interest payment is only part of what you'll pay. In many cases, your payment includes an escrow for residential or commercial property taxes and insurance. That means the home mortgage company collects the money from you, keeps it, and makes the appropriate payments when the time comes. Lenders do that to secure themselves.

What Is Required Down Payment On Mortgages Things To Know Before You Get This

doi:10.1016/ j.jue. 2015.08.002. Schwartz, Shelly (May 28, 2015). " Will a reverse home mortgage be your buddy or opponent?". CNBC. Obtained December 24, 2018. " Reverse home mortgages". ASIC Money Smart Site. Retrieved 28 September 2016. " Consumer Credit Guideline". ASIC Cash Smart Site. Obtained 28 September 2016. " Reverse Mortgages". National Details Centre on Retirement Investments Inc (NICRI).

" How does a Reverse Home mortgage work?". Equity Keep. Equity Keep. " Reverse Mortgage Retirement Loans Macquarie". www.macquarie.com. Recovered 2016-10-06. " Rates & fees". Commonwealth Bank of Australia. Recovered 13 September 2012. " Why Reverse Home loan? Top 7 Reverse Home Mortgage Function". Retrieved 2016-10-06. " Functions". Commonwealth Bank of Australia. Retrieved 13 September 2012. " Effects on your pension".

Obtained 12 September 2012. " Reverse Home mortgages". ASIC Cash Smart Site. Obtained 28 September 2016. Wong = Better House Canada's, Daniel (December 26, 2018). " Canadian Reverse Home Loan Debt Just Made One of The Most Significant Jumps Ever". Better Residence. Recovered January 2, 2019. " Understanding reverse home mortgages". Financial Customer Company of Canada. Government of Canada.

Recovered 20 December 2015. " Reverse Home Loan Tricks - The Truth About CHIP Reverse Home Mortgages". Reverse Home Loan Pros. Dominion Financing Centres Edge Financial. Recovered 31 January 2017. " Home Earnings Plan (Reverse Home Mortgage in Canada): How Does a Canadian Reverse Mortgage Work". Origin Mortgages DLC. Retrieved 12 September 2012. " Reverse Home loans: How the Strategy Functions".

Recovered 11 September 2012. [] Heinzl, John (31 October 2010). " The reverse mortgage dilemma". The Globe and Mail. Recovered 12 September 2012. " Reverse Mortgage Costs And Costs - All You Need To Know". Reverse Home Mortgage Pros. Rule Loaning Centres Edge Financial. 2018-03-24. Retrieved 12 October 2018. " Costs And Charges For A Reverse Home mortgage".

Rule Financing Centres Edge Financial. 2018-03-24. Retrieved 12 October 2018. " The Reverse Mortgage Credit Line;". Reverse Home Loan Pros. Rule Lending Centres Edge Financial. Obtained 7 November 2017. " Top 8 Common Misconceptions". Reverse Mortgage Pros. Rule Loaning Centres Edge Financial. 2018-01-25. Obtained 12 October 2018. " Reverse Mortgage Pros". Reverse Home Loan Pros.

The 5-Second Trick For What Is The Current Variable Rate For Mortgages

Retrieved 31 January 2017. " Text of S. 825 (100th): Housing and Neighborhood Advancement Act of 1987 (Passed Congress/Enrolled Costs variation) - GovTrack.us". GovTrack.us. Obtained 2015-12-22. "- REVERSE MORTGAGES: POLISHING NOT TAINTING THE GOLDEN YEARS". www.gpo.gov. Obtained 2015-12-23. 12 U.S.C. 1715z-20( b)( 1 ); 24 C.F.R. 206.33. (PDF). 12 U.S.C. 1715z-20( b)( 4) 12 U.S.C. 1715z-20( d)( 3 ).

United States Department of Housing and Urban Advancement. 14 October 2010. Archived from the initial on 2012-09-06. Recovered 11 September 2012. " Reverse Home loan: What is it and how does it work? 2016-10". " Intriguing how to cancel sirius xm radio Reverse Mortgage Realities". 2014-06-11. Obtained 2014-07-03. (PDF). " MyHECM Principal Limit Calculator". HUD Mortgagee Letter 2014-12 (June 27, 2014) " How Reverse Home Loans Work".

March 2010. Obtained 11 September 2012. (PDF). " Archived copy". Archived from the original on 2010-06-14. Retrieved 2009-06-06. CS1 maint: archived copy as title (link) Ecker, Elizabeth (2013-11-06). " Texas Votes "Yes" to Enable Reverse Home Loan For Purchase Product". Recovered 2014-01-10. Sheedy, Rachel L. (January 2013). " Buy a House With a Reverse Home mortgage".

Obtained 2014-01-10. Coates, Tara (11 February 2011). " 10 Things You Ought To Learn About Reverse Mortgages: Prior to you sign, make certain you learn about restrictions, fees". AARP.com. Reverse Home Mortgages: A Legal representative's Guide. American Bar Association. 1997. " Info on Reverse Home Mortgages". AARP. 12 U.S.C. 1715z-20( j). (PDF). See Home Equity Conversion Mortgages Regular Monthly Report (May 2010), http://www.hud.gov/offices/hsg/comp/rpts/hecm/hecmmenu.cfm Archived 2010-05-28 at the Wayback Device Club.

No. 109-289, s. 131 (2006 ). See for instance the Omnibus Appropriations Act, 2009, Pub. L. No. 111-8, s. 217 (Mar. 11, 2009). For HUD's HECM Summary Reports, see http://www.hud.gov/pub/chums/f17fvc/hecm.cfm Archived 2015-09-24 at the Wayback Maker, United States Census Bureau, 2000-01-13. Accessed 2015-06-30. Archived 2015-09-24 at the Wayback Device Projections of the Total Local Population by 5-Year Age, and Sex with Unique Age Categories: Middle Series, 2025 to 2045], United States Census Bureau, 2000-01-13.

" National Retirement Threat Index Center for Retirement Research Study". crr.bc.edu. Recovered 2016-07-14. " Working Paper: HECM Reverse Home Mortgages: Is Market Failure Fixable? - Zell/Lurie Center". realestate.wharton.upenn.edu. Recovered 2016-07-14. HKMC Reverse Home Mortgage Programme - http://www.hkmc.com.hk/eng/our_business/reverse_mortgage_programme.html " How much will a reverse home loan expense?". Consumer Financial Security Bureau. Retrieved 2020-01-02. Santow, Simon (25 May 2011).

What Is A Basis Point In Mortgages Things To Know Before You Buy

Australian Broadcasting Corporation (ABC). Obtained 12 September 2012. (PDF). June 2012. Recovered 12 September 2012. Hallman, Ben (27 June 2012). " Reverse Home Loan Foreclosures On The Increase, Senior Citizens Targeted For Frauds". Huffington Post. Obtained 12 September 2012. " Reverse Home mortgages Are Not the Next Sub-Prime". mtgprofessor.com.

Traditionally thought about a last-ditch source of money for qualified homeowners, reverse home loans are ending up being more popular. Older Americans, particularly retiring child boomers, have significantly drawn on this financial tool to fund things like home restorations, consolidate debt, pay off medical costs, or just improve their way of lives. So what is a reverse home loan? It's a type of loan that enables homeowners to turn part of the value of their home into cash.

Unlike a 2nd home loan or a home equity loan, the reverse mortgage does not have actually to be paid back till a borrower passes away, offers your house, or leaves permanently. The Federal Housing Authority (FHA) provides a Mortgagee Optional Election assignment program that is developed to allow non-borrowing partners to remain in the house as long as the loan was taken out after they were wed and have stayed married and home taxes are up to date.

Home equity conversion home loans (HECMs) can also be utilized later on in life to help fund long-term care. However, if the borrower relocates to another house for a major portion of the year or to a nursing house or similar kind of assisted living for more than 12 successive months, the reverse mortgage will require to be paid back.

However reverse home mortgages likewise come with downsides, and they aren't for everyone. Depending on things like your age, home equity and objectives, options like personal loans, cash-out refinancing or house equity loan, might be a much better fit and come without the limitations of a reverse home loan. Reverse home mortgages were developed to assist retired people who own and live in their homes however have restricted cash circulation to cover living expenditures.

Reverse home loans are just offered to individuals who have settled their home mortgage totally or have an adequate amount of equity. Borrowers need to also utilize the home as their main house or, if living in a two-to-four unit house owned by the borrower, then he or she must inhabit one of the systems - how many types of reverse mortgages are there.

The smart Trick of What Are Basis Points In Mortgages That Nobody is Discussing

The borrower can not have any delinquent federal financial obligation. Plus, the following will be verified before approval: Customer income, properties, monthly living costs, and credit rating On-time payment of genuine estate taxes, plus hazard and flood insurance coverage premiums, as suitable The reverse mortgage amount https://apnews.com/Globe%20Newswire/8d0135af22945c7a74748d708ee730c1 you receive is determined based on the lesser of the evaluated worth or the HECM FHA mortgage limitation (for purchase the list prices), the age of the youngest debtor or age of qualified non-borrowing spouse, and present interest rates.

Debtors, or their beneficiaries, typically repay the reverse home mortgage by eventually selling your home. The most typical kind of reverse mortgage is a HECM, which is insured by the FHA and offers certain customer defenses. These loans presently have a limitation of $765,600. One eligibility requirement is that you meet with an HECM counselor.

What Is The Current Interest Rate On Reverse Mortgages Fundamentals Explained

As soon as you do, you have a year to close the loan. If you relocate to an assisted living home, you'll most likely need the equity in your home to pay those expenses. In 2016, the average expense of an assisted living home was $81,128 annually for a semi-private room. If you owe a lending institution a considerable piece of the equity in your house, there will not be much left for the retirement home.

The high expenses of reverse home mortgages are not worth it for many people. You're much better off offering your house and relocating to a less expensive place, keeping whatever equity you have in your pocket rather than owing it to a reverse home mortgage loan provider. This short article is adjusted from "You Don't Have to Drive an Uber in Retirement" Home page (Wiley) by Marc Lichtenfeld.

Reverse home mortgages sound enticing: The advertisements you see on television, in print and online offer the impression that these loans are a risk-free way to fill monetary gaps in retirement. However, the ads don't always inform the entire story. A reverse mortgage is a special kind of house equity loan offered to house owners aged 62 and older.